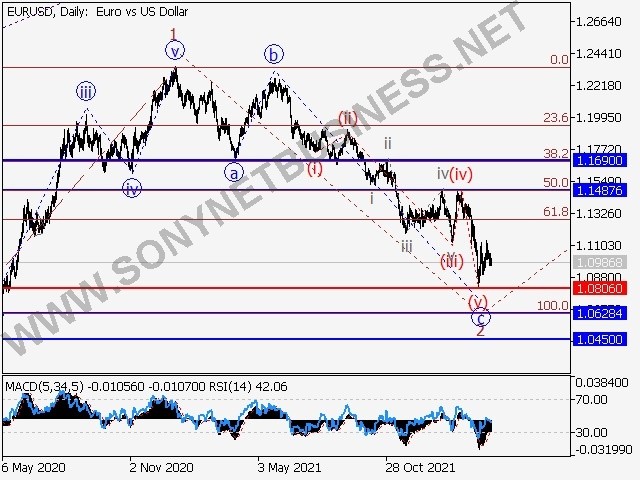

EURUSD : Elliott signal analysis and projections for March 25th to April 1st, 2022

Long positions from corrections above 1.0806 with a target of 1.1487 – 1.1690 are the main scenario.

Alternative scenario: The pair will continue to fall to levels of 1.0628 – 1.0450 if it breaks and consolidates below the level of 1.0806.

Analysis: daily chart: the first wave of bigger degree 1 of (3) has developed, and wave 2 of the downside correction has appeared (3). On the H4 chart, it appears that the third wave 3 of (3) has begun to form. On the H1 chart, the first wave of smaller degree I of I of 3 is forming, with wave I forming and corrective wave ii of I nearing completion inside. Once adjustment ii of I is completed, if the presumption is right, the pair will continue to increase to levels of 1.1487 – 1.1690. In this circumstance, the level of 1.0806 is crucial. Its breakout will cause the pair to tumble to levels between 1.0628 and 1.0450.

|

| EURUSD : Elliott signal analysis and projections for March 25th to April 1st, 2022 |

GBPUSD : Elliott signal analysis and projections for March 25th to April 1st, 2022

Short positions from corrections below 1.3302 with a target of 1.3000 – 1.2831 are the main scenario.

Alternative scenario: The pair will continue to rise to levels of 1.3414 – 1.3638 if it breaks out and consolidates above the level of 1.3302.

On the daily chart, the first wave of larger degree (1) has developed, and a descending corrective is developing as wave 2. (2). Wave B of (2) has completed on the H4 chart, and wave C of (2) is forming. The third wave of smaller degree iii of C looks to have formed on the H1 chart, a local correction as the fourth wave iv of C has been finished, and wave v of C has begun to unfold. The pair will continue to fall to 1.3000 – 1.2831 if this assumption is right. In this scenario, the level of 1.3302 is key, as a breakout will allow the pair to continue advancing to levels of 1.3414 – 1.3638.

|

| GBPUSD : Elliott signal analysis and projections for March 25th to April 1st, 2022 |

USDCHF : Elliott signal analysis and projections for March 25th to April 1st, 2022

Long positions from corrections above 0.9146 with a target of 0.9506 – 0.9683 are the main scenario.

Alternative scenario: The pair will continue to fall to levels of 0.8924 – 0.8768 if it breaks and consolidates below the level of 0.9146.

On the daily chart, a descending first wave of larger degree (1) of 5 has developed, and a correction is forming as the second wave (2) of 5, with wave C of (2) forming inside. On the H4 chart, the third wave of smaller degree iii of C is forming, with wave (iii) of iii forming inside.On the H1 chart, wave iii of (iii) appears to be forming, and a local correction as wave iv of (iv) is nearing completion (iii). If the prediction is true, the pair will continue to increase after the correction to levels between 0.9506 and 0.9683. In this circumstance, the level of 0.9146 is critical. The pair will be able to continue sliding to levels of 0.8924 – 0.8768 as a result of its breakout.

|

| USDCHF : Elliott signal analysis and projections for March 25th to April 1st, 2022 |

USDJPY : Elliott signal analysis and projections for March 25th to April 1st, 2022

Long positions from corrections over 118.48 with a goal of 124.50 – 126.00 are the main scenario.

Alternative scenario: The pair will continue to fall to levels of 114.57 – 111.92 if it breaks and consolidates below the level of 118.48.

On the daily chart, the third wave of bigger degree 3 is likely still developing, with wave iii of 3 forming as part of it. On the H4 chart, the third wave of smaller degree (iii) has developed, the corrective wave (iv) of iii has completed development, and the fifth wave (v) of iii is forming. On the H1 chart, the third wave iii of (v) appears to have formed. If this assumption is right, and a local adjustment iv of (v) is accomplished, the pair will continue to increase to 124.50 - 126.00. In this situation, the level of 118.48 is crucial, as a break will allow the pair to continue falling to the levels of 114.57 – 111.92.

|

| USDJPY : Elliott signal analysis and projections for March 25th to April 1st, 2022 |

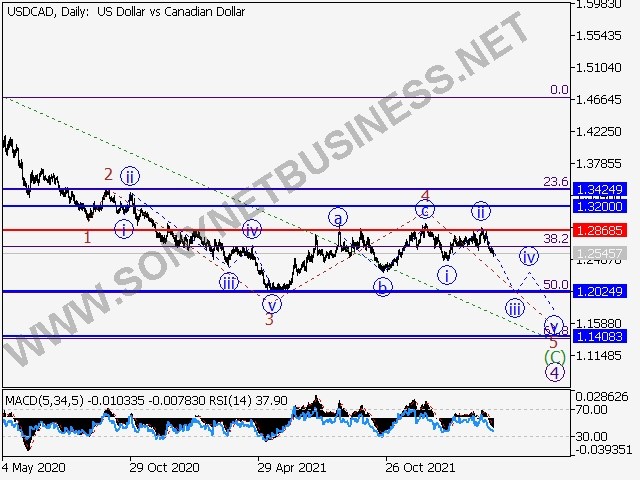

USDCAD : Elliott signal analysis and projections for March 25th to April 1st, 2022

Short positions from corrections below 1.2868 with a target of 1.2024 – 1.1408 are the main scenario.

Alternative scenario: The pair will continue to rise to levels of 1.3200 – 1.3424 if it breaks out and consolidates above the level of 1.2868.

On the daily chart, a descending correction looks to be continuing as the fourth wave 4 of larger degree, with wave (C) forming inside. On the H4 chart, an ascending corrective has completed as wave 4 of (C), and the fifth wave 5 of (C) is forming. A local correction looks to have completed as wave ii of 5, and wave iii of 5 is starting, with wave (iii) of iii developing as its portion, on the H1 chart. If the prediction is true, the pair will continue to fall to 1.2024 – 1.1408 levels. In this scenario, the level of 1.2868 is key, as a breakout will allow the pair to continue advancing to levels of 1.3200 – 1.3424.

|

| USDCAD : Elliott signal analysis and projections for March 25th to April 1st, 2022 |

XAUUSD : Elliott signal analysis and projections for March 25th to April 1st, 2022

Long positions from corrections above 1909.07 with a goal of 2070.98 – 2150.00 are the main scenario.

Alternative scenario: The pair will continue to fall to levels of 1853.64 – 1779.58 if it breaks and consolidates below the level of 1909.07.

On the daily chart, the fifth wave of larger degree (5) is still developing, with wave 3 of (5) forming inside. On the H4 chart, it appears like wave iii of 3 is forming, with wave iii of smaller degree (iii) forming as part of it. A local correction has apparently completed as the fourth wave (iv) of iii on the H1 chart, and the fifth wave (v) of iii has begun to form. If the forecast is true, the pair will increase to levels between 2070.98 and 2150.00. In this situation, the level of 1909.07 is crucial, as a break will allow the pair to continue falling to the levels of 1853.64 – 1779.58.

|

| XAUUSD : Elliott signal analysis and projections for March 25th to April 1st, 2022 |

.png)

.png)