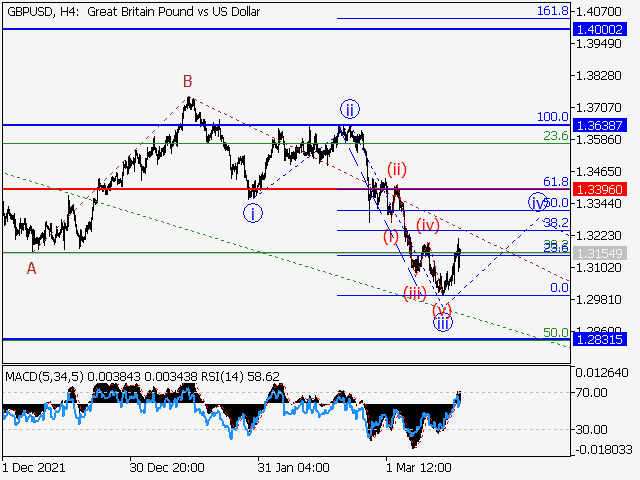

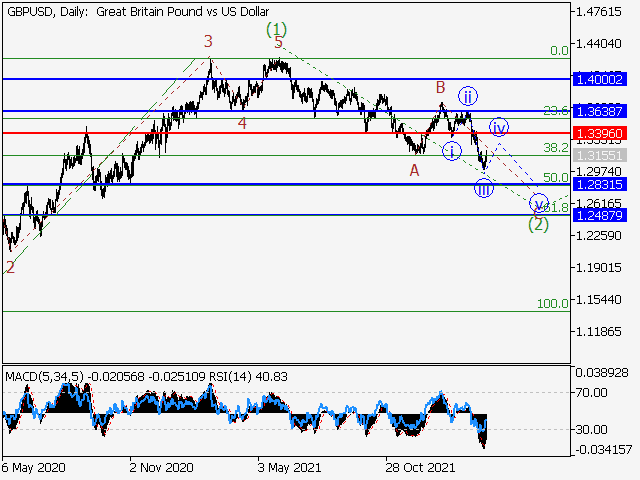

Short positions from corrections below 1.3396 with a target of 1.2831 – 1.2487 are the main scenario.

Alternative scenario: The pair will continue to rise to levels of 1.3638 – 1.4000 if it breaks out and consolidates above the level of 1.3396.

On the daily chart, the first wave of larger degree (1) has developed, and a descending corrective is developing as wave 2. (2). Wave B of (2) has completed on the H4 chart, and wave C of (2) is currently developing. The third wave of smaller degree iii of C looks to have formed on the H1 chart, and the fourth wave iv of C is emerging as a local correction. If this prediction is right, the pair will continue to decrease when the local correction ends, to 1.2831 – 1.2487. In this scenario, the level of 1.3396 is key, as a breakout will allow the pair to continue advancing to levels of 1.3638 – 1.4000.

|

| GBPUSD Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

|

| GBPUSD Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

|

| GBPUSD Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

.png)

.png)