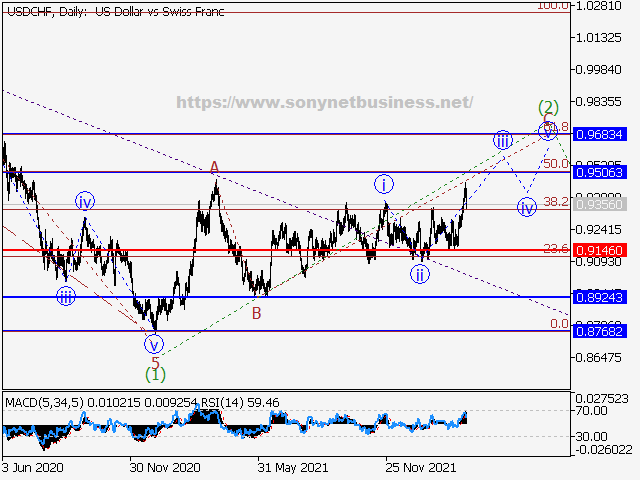

Long positions from corrections above 0.9146 with a target of 0.9506 – 0.9683 are the main scenario.

Alternative scenario: The pair will continue to fall to levels of 0.8924 – 0.8768 if it breaks and consolidates below the level of 0.9146.

On the daily chart, a descending first wave of larger degree (1) of 5 has developed, and a correction is forming as the second wave (2) of 5, with wave C of (2) forming inside. On the H4 chart, it appears like the third wave of smaller degree iii of C is developing, with wave (iii) of iii forming inside. On the H1 chart, wave iii of (iii) looks to have formed. If this assumption is right, once corrective wave iv of (iii) is completed, the pair will continue to rise to 0.9506 – 0.9683. In this circumstance, the level of 0.9146 is critical. The pair will be able to continue sliding to levels of 0.8924 – 0.8768 as a result of its breakout.

|

| USDCHF Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

|

| USDCHF Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

|

| USDCHF Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

.png)

.png)