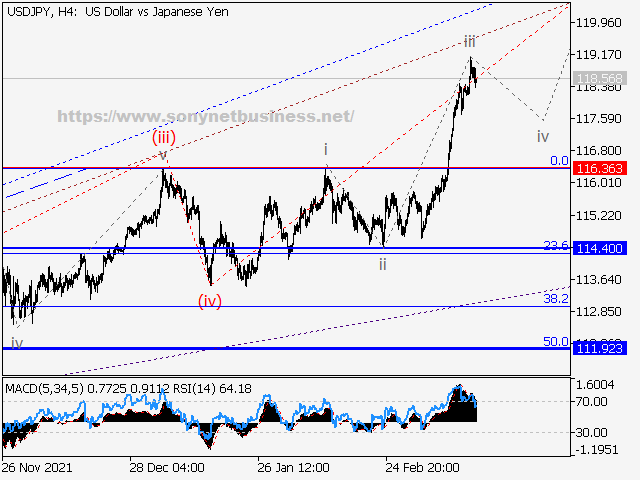

The main scenario is to take long positions on corrections above 116.36 with a target of 121.00–123.00.

Alternative scenario: The pair will continue to fall to levels of 114.40 – 111.92 if it breaks and consolidates below the level of 116.36.

On the daily chart, the third wave of bigger degree 3 is likely still developing, with wave iii of 3 forming as part of it. On the H4 chart, the third smaller degree (iii) of iii has developed, the corrective wave (iv) of iii has finished developing, and the fifth wave (v) of iii is forming. On the H1 chart, it appears like the third wave iii of (v) is forming. The pair will continue to increase to 121.00 – 123.00 if this assumption is right. In this situation, the level of 116.36 is crucial, as a break will allow the pair to continue falling to the levels of 114.40 – 111.92.

|

USDJPY Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

|

USDJPY Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

|

USDJPY Elliott Wave Analysis and Forecast for the Week of March 18th to March 25th |

.png)

.png)