There was a period when only significant participants like large financial institutions, brokerages, and trading houses could participate actively in the markets. With the advent of the internet, however, brokers were able to make trading accessible to the general public.

The concepts "trading" and "investment" are not interchangeable. Investing entails owning stocks for an extended period of time, whereas trading is usually associated with the short term. Day trading is defined as the buying and selling of a security inside a single trading day in the world of finance. A day trader is someone who trades on a daily basis. As a result, they essentially forecast the market's current price behaviour. They often open and close all of their positions on the same trading day.

Technical analysis is frequently associated with day trading. It is critical to have tactics that work consistently in day trading to be successful. The following are some of the more generally classed strategies.

Scalping is the practise of attempting to profit from minor price swings throughout the day.

New based trading : As the name implies, it involves trading stocks in response to breaking news. People favour this type of trading because it provides more volatility.

Trading opportunities at the support and resistance levels are sought in range trading.

High-frequency trading (HFT) is a type of trading that uses complex algorithms to take advantage of short-term inefficiencies.

The Requirements

Day trading is primarily related with technical analysis, as previously stated. And there is a widespread belief that this form of analysis is difficult. This is not the case. The key to understanding technical analysis is to stick to the fundamentals. A clear, straightforward, and effective method is especially important for day trading. The following are some of the fundamentals that every day trader should be aware of.

Education

We don't mean the strategy you're meant to apply when we say education. Apart from the strategy, it's also important to keep up with market news and any events that can have an impact on your security.

The number three is the upper limit.

Despite the fact that there are many pairs on the market, you should not focus on more than three. Overtrading leads to confusion and, as a result, to a loss. As a result, if you're a beginner, it's best to start modestly.

Managing your finances

Money management is just as crucial as trading technique. Because day trading allows one to avoid losing money even if the market does not move in their favour. Have a plan for how much you're willing to lose on each deal as a novice. Successful traders rarely put more than 2% of their cash at risk in a single trade. One must also be prepared to lose money on some trades.

Every strategy requires certain components.

Whether it's price action trading, algorithmic trading, or any other style of trading, there are a few elements that are universal to all methods and must be incorporated into each one.

Liquidity - In highly liquid markets, you can quickly open and cancel positions with steady prices.

Volatility - This simply informs you how much money you can make or lose on a trade.

Trading Techniques

We've covered some of the most effective day trading tactics that every trader should be aware of. These methods are simple, yet without them, it is impossible to be a successful day trader. We've also provided live trading samples so you can have a better understanding of the techniques. Let's jump right into them.

Trading Strategy (High-Low)

This day trading technique is the most straightforward of all the tactics that will be discussed. This is more of a mathematical strategy than a technical one. And the elegance of its symmetry adds to its charm.

To begin, select a time period, such as ten days, and compute the high and low prices of the currency pair throughout that time period. Let's say the top and lowest prices are 1.0000 and 1.2000, respectively. Now, add the two and divide by two to get the average. This gives us a value of 1.1000, which we'll use in our plan.

Buys can be made when the current market price of the pair reaches or exceeds 1.2000. The average price of 1.1000 would be a good stop loss. In the same way, if the price touches or falls below the 1.0000 level, it's time to sell. The same average price1.1000 would serve as a stop loss.

This is, without a doubt, the most simple method for beginners. Traders must keep note of the number of profitable and unsuccessful deals generated by this technique. Only if the number of successful deals exceeds the number of unsuccessful trades may it be used again.

Trading Strategy with Pin Bars

In price action trading, the pin bar pattern is a prominent trading pattern. This design can be traded in a variety of ways. Here, we'll go over one basic, successful method that's ideal for novices.

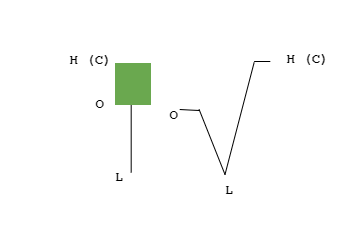

Let us first understand the pin bar candlestick pattern before moving on to this day trading approach. The market opened at point 'o,' proceeded down to point 'L,' and closed at point 'H,' as seen in the graph below. Despite the fact that the market fell, it quickly rebounded and closed above the open price, reflecting the power of the purchasers.

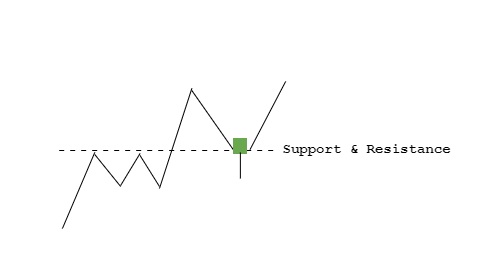

When it comes to the approach, the pin bar candlestick pattern and support and resistance levels are the main topics. The power of the buyers and sellers in the market is indicated by a support and resistance break. We wait for the market to break above a resistance level, as per the approach. When the price begins to retrace to the resistance turned support level, we expect a buy when the pin bar candle appears in that area.

Example of a Trade

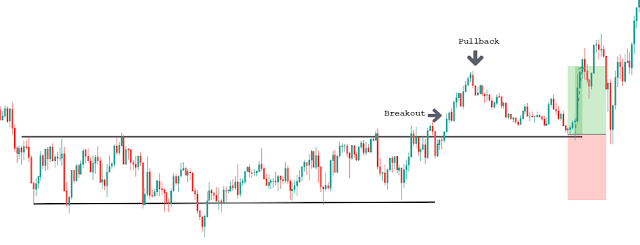

Consider the following scenario. After a period of range trading, the market broke above the resistance level (black dotted line). All we have to do now is wait for the market to pullback and provide us with the pin bar formation.

The market begins to decline after breaking over barrier (red candles). The pin bar candle appears when it hits the Support & Resistance Level (black dotted line). This shows that the buyers have returned to the market. As a result, one can enter a long position immediately when the pin bar candle closes.

Placement of Stop-Loss and Take-Profit Orders

Maintaining a rational stop loss is crucial for whatever method you deploy. When it comes to this approach, it seems sense to set a stop loss below the pin bar candle's low. The fact that the price has dropped indicates that the customer has decided to walk away.

A Take Profit at the recent highs is appropriate for this technique as a beginner. Intermediate and advanced traders may sell half of their positions at recent highs and leave the remainder to fly in anticipation of higher highs.

Trading Strategy for Breakouts

Breakout trading is the simplest forex trading method and is ideal for beginners. A breakout can be traded in a variety of ways. We'll go over a handful of them now. The goal of this technique is to predict a buy/sell opportunity once a breakout occurs. We may categorise them into distinct breakout tactics based on where the breakout occurs.

Breakout Strategy With A Wedge

When the market breaks out of a wedge pattern, this technique calls for waiting for the price to retrace to the wedge lines before attempting to go long or short.

Consider the graph below. The market is attempting to create lower lows and lower highs, resulting in the wedge pattern. However, it eventually breaks below the wedge. Now we must wait for the price to return to the wedge. We can ready to go short whenever the price reaches the bottom of the wedge.

Placement of Stop-Loss and Take-Profit Orders

This approach only requires a stop-loss above the wedge's latest peak (as seen in the chart).

Look behind you for the regions of support and opposition. This is where the profit is taken. Otherwise, as a beginning, it was suggested that you strive for no more than 1RR.

Breakout Strategy for the Range

Wait for the price to break above or below the range, as in the previous strategy. After the price has retraced to the support and resistance levels, enter a trade.

The market is obviously bouncing between the two black lines in the chart below, indicating that it is in a range. We'll wait for the price to break above/below the range now that we've established one, and then we'll open positions on this pair.

The price finally breaks through the resistance line. So, when the price falls below the resistance (now support) line, we can enter the buy.

Placement of Stop-Loss and Take-Profit Orders

The bottom of the range would be a good place to put a stop-loss. You can raise the stop-loss just below the top range line as you acquire experience. A take-profit order might be set near the resistance area of the higher timeframe.

Crossover of the Moving Average

Another beginner-friendly approach that use the simple moving average is this one. A moving average is a lagging indicator that uses historical price data and moves at a slower rate than the current market price. The slower it moves, the longer the duration is set. As a result, we use a longer moving average in conjunction with a shorter moving average in this technique. We'll use the 200-day moving average as the longer MA and the 25-day moving average as the shorter MA in this example.

When the shorter moving average moves above or below the longer moving average, it signifies a shift in trend, giving us a bullish or bearish signal, according to this technique.

The USD/CAD chart on the 4H timeframe is shown below. Two moving averages have been added to this graph. The 25-day moving average is shown by the orange line, while the 200-day moving average is represented by the blue line. When compared to the 200-day moving average, the 25-day moving average tracks the prices significantly more closely.

There are three crosses between the two moving averages in the chart. When the 20-day moving average falls below the 200-day moving average, the trend is changing. In technical terms, this signifies that recent prices are lower than previous ones. As a result, a sell signal is indicated.

Similarly, when the 25-day moving average crosses over the 200-day moving average, it indicates that recent prices are higher than previous ones, indicating a positive indication.

There is no precise entry or exit point in this method. However, in order to have strong liquidity and volatility, it is recommended that you trade this technique during market opening sessions.

Additional Resources

This method can also be utilised in tandem with the breakout strategy. If a breakout does not fit the broader trend shown by the moving average indicator, it should be discarded as a confirmatory tool. If, for example, the breakout occurs to the upside and the shorter moving average is below the longer moving average, such a setup should be ignored.

Using the Stochastic Indicator to Scale

Scalping is a type of trading that takes place over a short period of time. Day trading is frequently connected with scalping. We'll learn how to scalp with the stochastic indicator in this part.

A lower bound and an upper bound make up the stochastic indicator. The lower bound is known as the oversold area, and the upper barrier is known as the overbought area. When the two lines in the indicator cross above the oversold area, a long signal is generated, and when they cross below the overbought area, a sell signal is formed, according to the method.

We have six trading possibilities, four buys and two sells, as seen in the chart below. And it's worth noting that only once (the fifth) has the opportunity failed out of the six efforts. As a result, the strategy's consistency may be demonstrated. It is not advisable to utilise any indicator on its own. It is recommended that indicators be used in conjunction with other indicators to minimise trade risk.

Strategy for Support and Resistance

Without a question, the most significant phrase in the Forex sector is support and resistance. Support is a market location where buyers have a lot of power, whereas resistance is a market sector where sellers have a lot of strength. Trading these levels is a piece of cake.

When the price is in the support region, we seek to go long since the buyers in this area are powerful. We search for sell opportunities when the price is around the resistance region, since sellers control this area.

Consider the following scenario. We can easily see that the market is building a range between the two blue lines. To trade this, we purchase when the price reaches the bottom line (support) and sell when the price reaches the bottom line (resistance), as indicated. We can observe that four of the five transactions executed pip-to-pip.

The Strategy for the Spinning Top Candlestick Pattern

Another day trading method based on a candlestick pattern is this one. A single candlestick pattern known as a spinning top is utilised to provide trading signals. It's a candlestick with wicks on the top and bottom and a short body. This pattern represents market indecision. If this pattern appears in the charts, it means that neither buyers nor sellers are in control. This pattern, however, can still be used to provide buy and sell signals. A bullish and bearish Spinning Top candle are depicted below.

It's critical to recognise the indication supplied by the spinning top by looking at the dominating trend before the pattern appears. If the pattern appears after a decline, it indicates that the sellers are losing strength and that the market may be about to reverse direction. If the pattern appears after a dominant uptrend, it signifies the conclusion of the uptrend and the start of a decline.

It's not a good idea to press the buy or sell button based solely on the appearance of a pattern. It is always suggested to wait for confirmation when trading single candlestick patterns. A little range after the pattern occurs is adequate to prove the pattern's authenticity in this case.

Consider the graph below. The market was clearly in a downward trend, as can be shown. The spinning top candlestick pattern appeared after the price had been decreasing for quite some time. Later, the market even hovered in the same zone, indicating that the market is about to reverse course.

Placement of Stop-Loss and Take-Profit Orders

When it comes to stop losses and take profits, you should keep your stop loss well below the spinning top candle's low (bottom of the wick) and your take profit at the resistance or recent highs.

The Irrational Breakout Strategy

Technical analysis isn't the only way to trade. There's also a psychological component. And this mindset is frequently linked to false breakouts. False breakouts are similar in that they trap the populace in the wrong direction.

The fake breakout technique is one that is frequently used with other strategies. We'll look at how false breakouts can be used as a confirmation tool while trading a range.

Consider the graph below. We can easily observe that the market is trading in a range. Buying at support and selling at resistance is the classic strategy to trade a range. However, in this method, we do not trade when the price reaches certain levels. Instead, we'll watch for a breakout from these levels and a retracement of the rise. To put it another way, we expect a false breakthrough at the support and resistance levels.

When we look at the charts, we can see that the market dropped below the support and then immediately rebounded, generating a false breakout. As a result, now is the time to go long on this combination with confidence.

Final Thoughts

This essay was written with the intention of helping newcomers get their feet wet in day trading. We also hope you find this beginner's guide helpful. Note that the above techniques are only intended to provide new traders a general idea of how strategies function and how connected they are. It's also a good idea to try out these methods on a demo account before implementing them to a real account.

When it comes to day trading, it is a business that requires a lot of effort and patience to succeed in. Traders that day trade for the sake of making a fast buck almost always fail in the long run. In addition, technical analysis is the most important aspect of day trading. As a result, mastering technical analysis is the only way to succeed in this field. Finally, risk management is an important aspect of any day trading plan. It's futile to have a strategy with bad risk management.

.png)

.png)