|

| Types of Forex Brokers The A-Book and the B-Book |

To be successful in trading, you must first understand the differences between different types of Forex brokers.

Many brokers claim to be ECN brokers (the A-Book model), but their trading rules make it evident that they are not connected to an electronic communication network.

Other brokers claim to be STP but are actually ordinary Dealing Desks or kitchens. After all, a B-Book kitchen plan isn't always a con, so don't rush to label everything.

The numerous types of order processing models are discussed in this article. I'll go over the A-Book and B-Book models, their differences, and why the B-Book isn't always a bad idea. You'll also understand the differences between DD and NDD brokers, as well as the many forms of NDD order processing: STP, ECN, DMA, and MTF. I hope it aids you in your search for a reputable broker.

What are the different types of Forex brokers and order execution models?

Have you ever considered how Forex trades are carried out? It appears to be pretty straightforward from the trader's perspective. To open an order, simply click the button, and a confirmation of the transaction shows on the screen.

But who is the trader's counterparty? Is there any transaction going on? What factors influence transaction speed?

A-Book and B-Book models are the two types of broker operation modes. Client orders are transferred to the interbank forex market in a variety of ways using these methods.

Furthermore, depending on the sub-type, the A-Book and B-Book models use different order execution technologies, such as MM, NDD, STP, ECN, DMA, and MTF.

ECN-systems and MTF-systems are two different types of operation technologies.

Let's take a look at all of these confusing abbreviations. It won't be easy, but it will be really educational!

Managing client orders using the A-Book and B-Book models

A counterparty in the foreign exchange market is required to conduct a transaction. Someone must sell an asset if it is purchased. The counterparty and source of the A-Book and B-Book models are different:

- The trade orders are forwarded by A-Book brokers to the liquidity provider, who subsequently routes them to the interbank market. Commissions for a predetermined volume of transactions (often 1 lot) or a markup on a spread are the broker's earnings. In this system, the broker serves solely as a middleman; the final counterparty to the transaction is either a trader or a liquidity provider whose opposite transactions are in the interbank market.

- B-Book brokers function as market makers and process their clients' orders in-house. Because the broker performs trades internally, there is no external liquidity pool. The B-Book model is also known as a kitchen, but it's not quite that straightforward.

In the A-Book paradigm, there are no competing interests. The broker is merely a middleman who facilitates the exchange of financial information. If a trader's trading volume and turnover grow, the broker's commission will increase as well.

Because the broker acts as the counterparty to fill the trader's transaction, the B-Books concept is sometimes connected with a fraud. Clearly, there is a conflict of interest because the broker serves as both a middleman and a counterparty. As a result, the firm could set non-market quotes in the terminal, monitor client stop-loss orders using the MT4 add-on software, and trigger stops using the platform's server plugins. As a result, such a broker could do everything possible to cause the trader to lose money.

Many brokers, on the other hand, use the B-Books and do not even hide them. Brokers must enter into contracts with liquidity providers (and, in most cases, more than one), get licences, and provide technological assistance in order to transfer customer orders to the external market. All of these are expenses that the A-Book broker covers by charging a large spread mark-up.

That instance, the A-Book broker cannot compete on price with the B-Book broker. Traders, on the other hand, are unfamiliar with all of these models and prefer more advantageous settings, which encourages the operation of such kitchens.

Important! The use of the B-Book model by a broker does not always imply that it is a kitchen broker (although such a probability is high). This could indicate that the broker uses its platform to fill tiny trades. Large transactions, on the other hand, can be sent to a liquidity provider and then to the Forex interbank market, either individually or in a group. This is the "hybrid" of the A-Book and B-Book models. A mix of cent (B-Book) and ECN (A-Book) accounts is an example of such a model. Because the broker does not function as a counterparty to transactions, there is no conflict of interest in this arrangement.

Pure B-Book brokers are far less trustworthy. The internal volumes on the broker's platform are insignificant when compared to interbank levels.

If a large client places a large order, the broker must either act as a counterparty or accept slippage. Both variants are kitchen features that do not imply anything positive to a trader. As a result, you should stay away from pure B-Book brokers.

This article will teach you about Forex trade processing methods, order execution types such as Market Execution and Instant Execution, and the A-Book and B-Book models. I'll go over the fundamentals of transferring transactions to the interbank market using the A-Book model and the hybrid scheme in further depth.

What is the difference between A-Book and B-Book brokers?

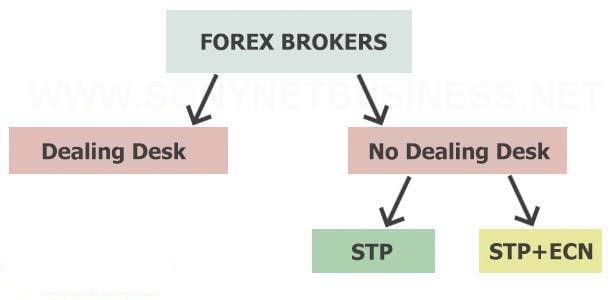

DD (Dealing Desk) and MM (Market Maker) models are two types of B-Book brokers.

A market maker is the trade's counterparty, and it seeks to find a matching order from its other clients (if the trader wants to buy 1 lot, the broker looks for someone who will sell 1 lot). If no such order exists, the market maker becomes a counterparty, creating a conflict of interest. The trader's loss becomes the market maker's profit in this situation. If the trader is profitable, the market maker can send the order to the liquidity aggregator, also known as the liquidity provider.

DD brokers, market makers, and Dealing Desk brokers are all the same counterparty that takes the other side of a client's deal and executes practically all of the trades through its own system. Dealing Desk brokers act as market makers, creating a market for the customer. A Dealing Desk has the ability to alter leverage, spread, quotation accuracy, artificially increase slippage, and manipulate customer orders. A kitchen is a pure Dealing Desk.

2. NDD (No Dealing Desk) model (A-Book)

The client's orders are passed to the interbank market through A-Books brokers. An NDD broker does not take the other side of a client's trade; instead, they act as a conduit between two parties. The broker adds a commission or a markup to the spread, slightly increasing it. To put it another way:

- It is a Dealing Desk, which can be compared to a kitchen, if the broker does not pass trades to the interbank market. Even if the broker has a licence, this is a crucial point to remember. A B-Book licence entitles the broker to fill their clients' orders within the system. A licence, of course, indicates that the broker is supervised by a regulatory agency.

- The broker is an NDD broker if it passes the client's trades to the interbank market, acting as an intermediary and using the A-Book model. When a broker is granted an A-Book licence, the regulator ensures that all transactions are routed through the software and into the interbank market.

In the interbank market, traders are traditionally split into two categories: Price Givers and Price Takers. The Price Giver is the person who makes a market offer, or places an order in the market (for example, a large institutional investor).

The Price Taker is the person who fulfils the order of the Price Giver. A Price Giver, to put it another way, issues an order in the interbank market specifying the purchase volume in lots and the price at which it is willing to acquire or sell the asset. The order is placed in the depths of the market, and Price Taker accepts the best order for it (at the best price and sufficient volume), forming a contract with Price Giver.

In the market, there are various different types of order execution.

2.1. NDD + STP order processing model (Straight Through Processing)

Brokers who use this technique send their clients' orders straight to their liquidity providers, who have interbank market access. The liquidity provider (any investor with a big capital base: banks, funds, and so on) is the one who sends the orders to the interbank market. Traders observe the liquidity provider's pricing in the Depth of Market, issue opposing orders through the broker, and the orders are executed instantaneously if all requirements are met.

Procedure for completing an order:

- The trader (Price Taker) observes the current price formed in the interbank market (broker acquires it from the quotes provider) and places an order in the trading platform.

- The broker sends the trader's order to the liquidity aggregator, which collects (aggregates) all Price Takers' orders and sends them to the liquidity provider.

- The orders are filled by a counterparty.

Traders are one of the transaction's parties in this paradigm. The other is large aggregators (typically banks). A broker is a participant who collects orders from brokers, while an aggregator is a participant who gathers orders from brokers.

Each broker can cooperate with as many aggregators and liquidity providers as they choose. The partnership's terms will be determined by order execution speed, spread, and commission. This system has various problems that are easier to demonstrate using examples.

1. There are two counterparties for a broker (liquidity providers). One offers a 3-pip spread with a $15 per lot commission. Another liquidity source charges a $10 commission and has a 5-pip spread. The broker system automatically sorts traders' proposals based on the best financial instrument prices. As a result, the broker pays the commission first, which causes a difficulty. The broker loses $5 since the majority of the turnover goes to the liquidity provider with the narrower spread. To address this issue, the broker adds a 2-pip markup to the first liquidity provider's spread, evenly distributing trades between the counterparties.

On the one hand, such a strategy stimulates competition among liquidity providers, resulting in a narrower spread and lower commission rates. Traders, on the other hand, do not receive the best price because of the spread mark-up. Another issue is that the quality of liquidity providers' services is degrading over time. As the quality of order execution declines, slippages appear.

Of course, the trader holds the broker responsible for everything. As a result, the broker is forced to deploy software to follow the provider's trickery. This activity, according to officials from a prominent trading firm, occurs even at the "highest Forex levels." In some cases, simply notifying the provider of the violation of contract is sufficient. Brokers may need to hunt for a new source on sometimes.

2. A vivid example is the instance of a well-known broker's British subsidiary, which used the STP model and went bankrupt in one day as a result. The agent's job description was as follows: a trader creates a position in the MT, and the broker opens a position with a liquidity provider at the same time (aggregator). That is, rather than acting as a neutral technical intermediary, the broker took involved in the transaction. The Swiss Central Bank then unpegged the franc at one point. The traders' long positions on the EUR/CHF pair swung from positive to negative in just one day.As a result, the broker's trades resulted in losses, resulting in a cash gap. Traders regained around 80% of their assets back thanks to segregated accounts, and the broker was forced to declare bankruptcy.

Following the SNB's decision to decouple the franc from the euro, there were a slew of bankruptcies. As a result, the pure STP approach is now uncommon, while some brokers continue to use it.

2.2. NDD + ECN (Electronic Community Network)

All traders and liquidity providers have equal rights under the ECN paradigm. The conditions of the STP model were mostly imposed on the trader by a specific provider. The ECN is a type of marketplace where anyone can make Bid/Ask orders that influence market liquidity.

The way trades are filled differs between the ECN and the STP. Traders can trade with each other in the ECN model. In the STP approach, on the other hand, the trader must match the offer of a certain liquidity provider (only the one with which the broker has an agreement).

Reference. The Depth of Market is a tool that displays current information on orders placed by sellers and purchasers. The trader observes prices and order volumes, which indicate market sentiment. The data about the best prices is displayed in the Level 1 Depth of Market. Level 2's Depth of Market provides detailed information on all orders placed.

You are not dealing with an ECN broker if there is no DOM of level 2, which can be utilised to gauge supply/demand and the price's future direction. It's a STP at best, and a DD at worst (B-Book).

Model for ECN order execution:

- When a trader on the platform sees the current interbank market pricing, he or she opens a position (creates an order).

- The orders are automatically sorted by price on the platform.

- Matching orders are executed promptly due to network liquidity (the platform unifies all liquidity providers and their traders, which is not the case with the STP model). The order execution time can range between 40 and 100 milliseconds (500 ms is the average speed in the ECN market).

The ECN model has an advantage over the STP in terms of the number of participants (both traders and liquidity providers). The more participants there are, the more liquidity (trading volumes) there is and the spread narrows. Every trader receives the best current Bid/Ask price because each participant seeks to offer the greatest price. The spread could be approaching 0 at times when the EURUSD has the most liquidity, but it can't be zero all the time.

The ECN system is another market player, a technological intermediary that allows orders to be processed. The broker can build its own ECN system, but it will be pointless because there will be a minimal number of players.

2.3. Hybrid execution paradigm with NDD, ECN, and STP

The A-Book hybrid forex broker model is one of the most prevalent approaches for large brokerage firms to provide technological support for trade execution. ECN/STP brokers mix both approaches without prioritising, focusing on the speed with which they may discover a matching trade.

However, ECN/STP brokers cannot be called pure ECN brokers because they do not provide traders with information about market depth (its liquidity). To figure out which broker you're dealing with, place a Limit order, which should be visible in the Depth of Market. It should be visible to a pure ECN broker.

(2.4).DMA (Direct Market Access) model

Direct Market Access, or DMA, is a type of trade execution in which brokers provide direct access to the interbank, allowing clients to issue trading orders with liquidity providers using the Depth of Market formulation. The benefits of the ECN and STP models are combined in this execution model.

The technology behind transaction processing is as follows:

- The platform's trader sees the current pricing, which is derived from the interbank market, and places an order.

- The order is passed on to the liquidity source with the best terms. If it's a Buy/Sell order, it'll be filled right away. It is presented in the Depth of Market visible to the trader if it is a pending order.

The ECN, on the other hand, is a virtual network that aggregates, sorts, and executes orders from all market players. DMA is similar to STP in that it distributes traders' orders among liquidity providers.

The table below provides an intermediate comparison study for three prominent NDD models (I will exclude DD and B-Book models that do not transfer orders to the external market).

What is the distinction between an A-Book and a B-Book broker?

A-Book broker features for ECN, STP, and DMA models:

- Market Execution is a sort of order execution.

- The spread varies. A fixed spread may imply that a commission is added to the best price by the broker or liquidity provider.

- There are no re-quotes in this article (they can rarely be observed only with the STP brokers).

- Slippages can occur in both positive and negative ways.

- There are no restrictions on the trading tactics that can be used. High-frequency trading tactics are encouraged by ECN brokers, who can offer their server capacity for algo trading.

2.5.MTF (Multilateral Trading Facility)

The Multilateral Trading Facility is the most recent order processing and execution system, and it shares many similarities with the ECN architecture. Typical MTF platform features include:

- In the order execution chain, MTF are not counterparties. MTFs, like ECNs, simply connect market participants regardless of their status (an individual trader or a market maker).

- Unlike ECNs, MTF platforms do not collaborate with quotations providers (Reuters, Bloomberg) to provide real-time quotes based on supply and demand.

The underlying distinction between MTF and ECN is a topic of discussion on the forums. If ECN systems date back to the 1990s, the MTF system is frequently connected with the LMAX platform, which debuted in 2010. It can appear as a Currenex-style platform or as a broker. LMAX appears to have simply tweaked the ECN technique and dubbed it MTF. In any case, in professional trading, the ECN approach is still the most common and popular.

Finally, there's the most crucial question. Why do you need to know all of this information? The spread (its size or type – fixed or variable), order execution speed, and the broker's reliability all affect the trader's profit. In the interbank market, quotes fluctuate in milliseconds. How soon the deal is transferred to the market determines the price at which the order will be executed.

- The order execution speed of the ECN model is the fastest. Because there is no margin from the broker, the spread is quite modest, but there is a commission for each traded lot. The technology is said to be both costly and difficult to implement. As a result, this model will appeal largely to professionals that prioritise quickness and have a sufficient volume of trades to cover the commission.

- The DMA and STP methods are ideal for forex traders who are just starting out and need to gain expertise. Because the ECN mechanism ensures transaction anonymity, large banks are hesitant to give the best rates. Competition pushes liquidity providers to offer better terms in DMA and STP models, where the brokers have contracts with specific suppliers. In principle, the DMA approach should have better spreads than the ECN model. In actuality, the trading expenses in ECN and DMA are nearly identical due to the commission imposed.

- The ECN model offers complete market depth.

The ECN isn't an ideal model, in my opinion. STP and DMA aren't the ideal forex broker models, in my opinion. In terms of order execution speed, trading costs, and slippages, each model offers advantages and disadvantages. I recommend that you try both models and pick the one that best suits your trading style and system.

I work with LiteFinance on a daily basis. It is an A-Book hybrid broker that is registered and regulated. Classic trading accounts (Classic, STP model) and professional ECN accounts are available to traders.

|

| SNB-What is the difference between A-Book and B-Book brokers.2 |

Here you may find out more about the trading conditions available for both types of trading accounts. The ECN account specification can be found here, as well as the Classic account specification.

I'm hoping you now have a basic understanding of order execution models. If you have any further questions, please leave them in the comments section and I will gladly respond. I wish you trading success!

.jpg)

..jpg)

%202.jpg)

.png)

.png)