EURUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

The primary scenario is to think about taking short positions on dips below the level of 1.0204 with a goal of 0.9800 to 0.9700.

Alternative scenario: The pair will be able to continue climbing to the levels of 1.0375–1.0618 with a breakout and consolidation above the level of 1.0204.

Analysis : On the weekly chart, an irregular flat ()-()-(C) indicates that a corrective wave of greater degree B is apparently still developing. On the daily chart, wave (B) of (B) looks to have finished forming, with wave (B) of (B) acting as its component. On the H4 chart, the fifth wave (v) of (v) of C is developing, with a local corrective finished as the fourth wave of smaller degree iv of (v). The (v) wave is generating wave v. If the assumption is accurate, the pair will keep falling until it reaches values between 0.9800 and 0.9700. In this case, the level of 1.0204 is crucial. The pair will be able to continue climbing once it breaks out to levels between 1.0375 and 1.0618.

|

| EURUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| EURUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| EURUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

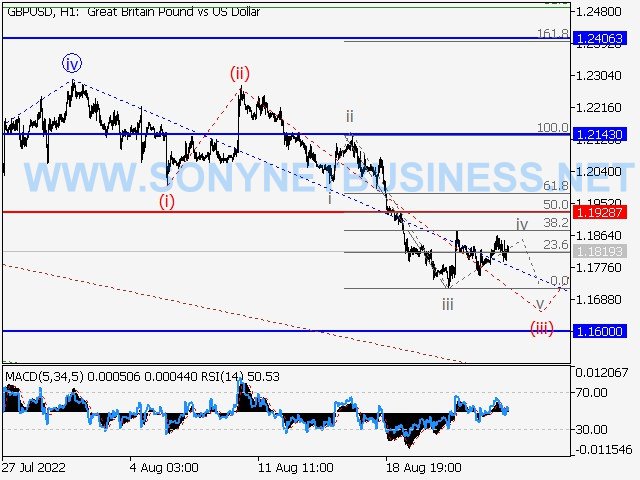

GBPUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

the 1.1600–1.1402 range as a target for short positions from corrections below the level of 1.1928.

An alternative possibility is that the pair will continue to rise to the levels of 1.2143–1.2406 after breaking out and consolidating above the level of 1.1928.

On the daily chart, the first wave of greater magnitude (1) forms, and a descending corrective continues to form as wave (2). On the H4 chart, wave C of (2) is developing, with the fifth wave v of C forming as a part of it. On the H1 chart, a local correction that is wave iv of (iii) inside the third wave of smaller degree (iii) of v of C appears to be forming. The pair will continue to fall to the levels of 1.1600 - 1.1402 if the assumption is right. In this scenario, the level of 1.1928 is crucial since a breakout there would allow the pair to continue advancing to levels between 1.2143 and 1.2406.

|

| GBPUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| GBPUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| GBPUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

USDJPY : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

the 127.35–123.53 range as a target for short positions from corrections below the level of 137.77.

An alternative scenario is that the pair will continue to rise to levels between 139.54 and 142.36 with a breakout and consolidation above the level of 137.77.

Analysis: On the daily chart, the third wave of larger degree (3) is taking shape, and wave (3) has developed as a part of it. On the H4 chart, a downside correction is still forming as the fourth wave 4 of (3), with wave an of 4 forming inside. On the H1 chart, wave (c) of b appeared to have begun to form while wave b of 4 appeared to have ceased developing. The pair will resume falling to the levels of 127.35 - 123.53 if the assumption is right. In this case, the level of 137.77 is crucial since a breakout there would allow the pair to advance further, to levels between 139.54 and 142.36.

|

| USDJPY : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| USDJPY : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| USDJPY : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

USDCHF : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

The primary scenario is to think about taking short positions from corrections below the level of 0.9887, with a target range of 0.9076 to 0.8918.

An alternative scenario is that the pair will continue to rise to levels between 1.0056 and 1.0350 with a breakout and consolidation above the level of 0.9887.

Analysis: On the daily chart, the fourth wave of larger degree (4) appears to have finished growing as an ascending corrective, and the fifth wave (5) of 5 began to take shape. The first wave of smaller degree 1 of (5), with wave I of 1 developed inside, is developing on the H4 chart. On the H1 chart, it appears that a local correction is developing as wave ii of 1. If this supposition is true, the pair will keep falling until it reaches the levels of 0.9076 and 0.8918 after the correction. In this case, the value of 0.9887 is crucial. The pair will be able to continue gaining once it breaks out to levels between 1.0056 and 1.0350.

|

| USDCHF : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| USDCHF : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| USDCHF : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

USDCAD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

1.2650–1.2540 would be the target range for short positions to be taken from corrections below the level of 1.3063.

Alternative scenario: The pair will continue to rise to the levels of 1.3220–1.3316 with a breakout and consolidation above the level of 1.3063.

Analysis: On the daily chart, the first wave of bigger degree (1) of 5 is likely forming, with wave (1) of (1) developed as a part of it. A descending correction is forming as the second wave 2 of (1) on the H4 chart, with waves b and c of that correction having already formed. On the H1 chart, it appears that the smaller degree (i) of c's first wave is produced, and the second (ii) of c's c's second wave completes a local correction. If the assumption is accurate, wave (iii) of c will see the pair continue to decline to levels between 1.2650 and 1.2540. In this scenario, the level of 1.3063 is crucial since a breakout there would allow the pair to continue advancing to the levels of 1.3220-1.3316.

|

| USDCAD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| USDCAD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| USDCAD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

WTI Crude Oil : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

Main scenario: From corrections above the level of 87.05, consider long positions with a target of 104.15 to 115.90.

An alternative possibility is that the asset will continue to decline to levels between 80.00 and 69.28 if it breaks out and consolidates below the level of 87.05.

Analysis: It appears that the greater degree (1) first wave is still developing on the daily chart, with (1) wave 3 having developed inside. On the H4 chart, it appears that a downward correction has reached its conclusion as the fourth wave 4 of (1) and that wave 5 has begun to take shape. On the H1 chart, a local correction is developing as wave iv of (i), which is the first counter-trend wave of smaller degree (i) of I of 5. If the assumption is accurate, the asset's price will increase after the correction to between 104.15 and 115.90. In this scenario, the level of 87.05 is crucial since a breakout would allow the price to continue falling to the levels of 80.00 - 69.28.

|

| WTI Crude Oil : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| WTI Crude Oil : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| WTI Crude Oil : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

XAUUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022

The primary scenario is to think about taking long positions from corrections above the level of 1727.18 with a target range of 1879.10 to 1997.97.

An alternative scenario is that the pair will continue to fall to levels between 1680.58 and 1650.00 with a breakout and consolidation below the level of 1727.18.

Analysis: On the daily chart, wave C of wave (4) has been completed inside what appears to be a downward corrective as the fourth wave (4) of larger degree. On the H4 chart, the fifth wave (5), which includes the first counter-trend wave of smaller degree I of 1 of (5) completed as its component, looks to be forming. On the H1 chart, the second wave ii of 1 has probably finished, and the third wave iii of 1 of (5) has begun to form. The pair will increase to the levels of 1879.10 - 1997.97 if the assumption is accurate. In this case, the level of 1727.18 is crucial because a break of it would allow the pair to continue sliding to levels between 1680.58 and 1650.00.

|

| XAUUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| XAUUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

|

| XAUUSD : Elliott wave analysis and forecast for 26.08.2022 – 02.09.2022 |

.png)

.png)