EURUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

The primary scenario is to think about taking short positions on dips below the level of 1.0196 with a target of 0.9700 to 0.9475.

An alternative possibility is that the pair will continue to rise to the levels of 1.0375–1.0618 after breaking out and consolidating above the level of 1.0196.

Analysis: On the weekly chart, an irregular flat ()-()-(C) indicates that a corrective wave of greater degree B is apparently still developing. On the daily chart, wave (B) of (B) is likely still developing, and wave (B) of (B) is still forming as its component. On the H4 chart, the fifth wave (v) of the v of C is forming. It comprises a local adjustment that was finished as wave iv of the smaller degree (iii) of wave (v) (v). The creation of wave v of (v). If the assumption is accurate, the pair will keep falling until it reaches values between 0.9700 and 0.9475. In this case, the level of 1.0196 is crucial. The pair will be able to continue climbing once it breaks out to levels between 1.0375 and 1.0618.

|

| EURUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| EURUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| EURUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

GBPUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

The primary scenario is to think about taking short positions on corrections below the level of 1.1737 with a target of 1.1190 to 1.1000.

An alternative scenario is that the pair will continue to rise to levels between 1.2280 and 1.2665 if it breaks out and consolidates above the level of 1.1737.

Analysis: Wave (3) of V is forming as the fifth wave of bigger degree V, which is likely developing on the daily chart. On the H4 chart, wave iii of wave 5 is forming inside the fifth wave of smaller degree 5 of (1). A local correction that was completed as wave (iv) of iii and wave (v) of iii are all visible on the H1 chart as waves (iii) of iii of 5 have formed. If the assumption is accurate, the pair will keep falling until it reaches values between 1.1190 and 1.1000. In this scenario, the level of 1.1737 is crucial since a breach there would allow the pair to continue advancing to levels between 1.2280 and 1.2665.

|

| GBPUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| GBPUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| GBPUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

USDJPY : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

Main scenario: From corrections above the level of 141.66, consider long positions with a target of 147.00–149.99.

An alternative scenario is that the pair will continue to decline to levels between 140.25 and 138.34 after breaking out and consolidating below the level of 141.66.

Analysis: Wave 3 of (3) was produced as the upward third wave of larger degree (3), which is still developing on the daily chart. On the H4 chart, the fourth wave 4 of (3) has finished forming, and the fifth wave 5 of (3) is still developing. The H1 chart appears to be creating the third wave of the smaller degree iii of 5, with a local correction (iv) of iii having already taken place and the fifth wave (v) of iii growing inside. If the assumption is accurate, the pair will increase to between 147.00 and 149.99. In this scenario, the level of 141.66 is crucial since a breakout would allow the pair to keep falling to the levels of 140.25 and 138.34.

|

| USDJPY : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| USDJPY : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| USDJPY : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

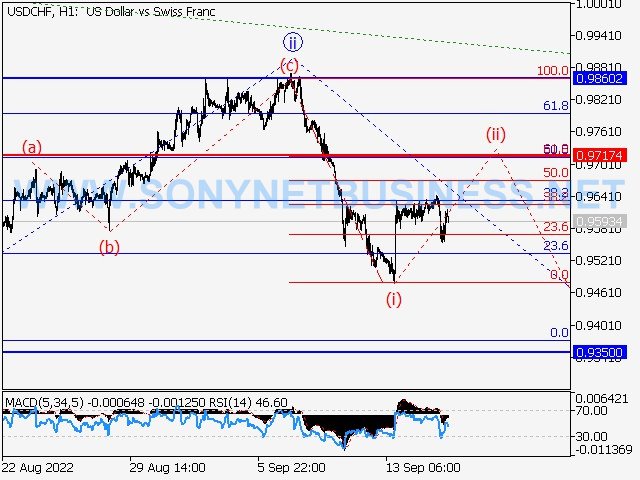

USDCHF : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

Main scenario: Take into account short positions below the level of 0.9717 with an after-correction goal of 0.9350 - 0.9076.

An alternative scenario is that the pair will continue to rise to the levels of 0.9860–1.0056 after breaking out and consolidating above the level of 0.9717.

Analysis: On the daily chart, the fourth wave of larger degree (4) appears to have finished growing as an ascending corrective, and the fifth wave (5) of 5 began to take shape. On the H4 chart, wave I of 1 has developed and a corrective has been finished as wave ii of 1, forming the first wave of smaller degree 1 of (5). On the H1 chart, it appears as though the third wave iii of wave 1 began to build, with a local corrective forming inside as wave of smaller degree (ii) of iii. If the assumption is accurate, the pair will continue to decline following the correction to levels 0.9351 to 0.9076. In this case, the value of 0.9717 is crucial. The pair will be able to continue climbing when it breaks through to levels between 0.9860 and 1.0056.

|

| USDCHF : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| USDCHF : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| USDCHF : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

USDCAD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

Main scenario: From corrections above the level of 1.2945, take into account long positions with a goal of 1.3430 to 1.3708.

An alternative possibility is that the pair will continue to decline to levels between 1.2721 and 1.2540 after breaking out and consolidating below the level of 1.2945.

Analysis: On the daily chart, the fifth wave of bigger degree 5 is likely developing, with waves (1) of 5 having formed and a corrective wave (2) of 5 having finished as its constituents. On the H4 chart, the first wave of smaller degree 1 of (3) and a corrective wave 2 of (3) formed inside the third wave (3) of 5, which has now begun to take shape. On the H1 chart, it appears that the third wave 3 of (3) began to build, with wave I of 3 having already formed and a local corrective developing as wave ii of 3. The pair will continue to increase until it reaches levels between 1.3708 and 1.3430 if the assumption is right. In this case, the level of 1.2945 is crucial because a break of it would allow the pair to continue falling to levels between 1.2721 and 1.2540.

|

| USDCAD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| USDCAD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| USDCAD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

WTI Crude Oil : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

The primary scenario is to think about taking short positions from corrections below the level of 90.26 with a target range of 69.28 to 54.60.

An alternative scenario is that the asset will continue to rise to levels between 98.30 to 115.90 after breaking out and consolidating above the level of 90.26.

Analysis: The daily chart appears to have created the first wave of greater degree (1), and the second wave, a downside correction, is currently developing (2). On the H4 chart, waves A and B of (2) appear to have developed, while wave C of (2) has begun to take shape. On the H1 chart, it appears that wave I of C, the smaller degree first counter-trend wave, appeared, followed by wave ii of C, a local correction, and wave iii of C beginning to form. If this supposition is true, the asset's price will keep decreasing until it reaches the range of 69.28 and 54.60. In this scenario, the level of 90.26 is crucial since a breakout there would allow for further price growth to levels between 98.30 and 115.90.

|

| WTI Crude Oil : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| WTI Crude Oil : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| WTI Crude Oil : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

XAUUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22

The primary scenario is to think about taking short positions from corrections below the level of 1734.53 with a target range of 1601.03 to 1491.84.

An alternative scenario is that the pair will continue to rise to levels between 1809.33 and 1879.10 after breaking out and consolidating above the level of 1734.53.

Analysis: On the daily chart, a bearish correction is apparently still developing as the fourth wave of bigger degree (4), with wave C of (4) still forming inside. On the H4 chart, the fifth wave of smaller degree (v) of iii of C is reportedly forming inside the third wave iii of C. On the H1 chart, wave v of (v) of iii is developing. If the assumption is accurate, the pair will keep decreasing until it reaches 1601.03 - 1491.84. In this case, the level of 1734.53 is crucial since a breach there would allow the pair to continue climbing to levels between 1809.33 and 1879.10.

|

| XAUUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| XAUUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

|

| XAUUSD : Elliott wave analysis and forecast for 16.09.22 – 23.09.22 |

.png)

.png)