EURUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

The primary scenario is to think about taking short positions from corrections below the level of 1.0177, with a target range of 0.9700 to 0.9475.

Alternative scenario: The pair will be able to continue climbing to the levels of 1.0375 - 1.0618 with a breakout and consolidation above the level of 1.0177.

Analysis: On the weekly chart, an irregular flat ()-()-(C) indicates that a corrective wave of greater degree B is apparently still developing. On the daily chart, wave (B) of (B) looks to have finished forming, with wave (B) of (B) acting as its component. On the H4 chart, the fifth wave (v) of the v of C is forming. As a component of it, a wave of degree iii of (v) of lower size formed, and wave iv of a local correction began to form (v). After wave iv of (v) is created, if the assumption is accurate, the pair will continue to decline to the levels 0.9700 - 0.9475. In this case, the value of 1.0177 is crucial. The pair will be able to continue climbing once it breaks out to levels between 1.0375 and 1.0618.

|

| EURUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| EURUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| EURUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

GBPUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

The primary scenario is to think about taking short positions from corrections below the level of 1.1910 with a target range of 1.1190 to 1.1000.

An alternative scenario is that the pair will continue to rise to levels between 1.2280 and 1.2665 if it breaks out and consolidates above the level of 1.1910.

Analysis: Wave (3) of V is forming as the fifth wave of bigger degree V, which is likely developing on the daily chart. On the H4 chart, wave iii of wave 5 is forming inside the fifth wave of smaller degree 5 of (1). On the H1 chart, it appears that wave (iii) of wave (iii) of 5 has developed, and wave (iv) of wave (iii) of 5 has begun to form locally (iii). If the assumption is accurate, the pair will continue to decline after correction to levels 1.1190 - 1.1000. In this scenario, the level of 1.1910 is crucial since a breach there would allow the pair to continue advancing to levels between 1.2280 and 1.2665.

|

| GBPUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| GBPUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| GBPUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

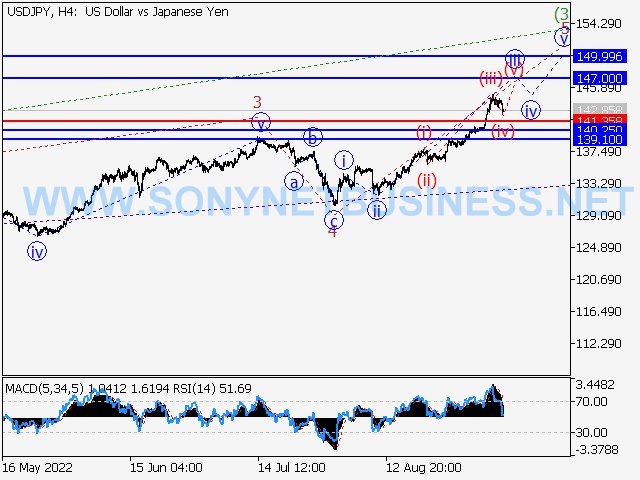

USDJPY : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

Main scenario: From corrections above the level of 141.35, consider long positions with a target of 147.00–149.99.

An alternative scenario is that the pair will continue to fall to levels between 140.25 and 139.10 after breaking through and consolidating below the level of 141.35.

Analysis: Wave 3 of (3) was produced as the upward third wave of larger degree (3), which is still developing on the daily chart. On the H4 chart, the fourth wave 4 of (3) has finished forming, and the fifth wave 5 of (3) is still developing. On the H1 chart, it appears that the third wave of smaller degree iii of 5 is forming, and a local corrective (iv) of iii is probably nearing completion inside. If the assumption is accurate, the pair will continue to increase after the correction, reaching values between 147.00 and 149.99. In this case, the level of 141.35 is crucial because a breakout would allow the pair to continue falling to the levels of 140.25 and 139.10.

|

| USDJPY : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| USDJPY : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| USDJPY : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

USDCHF : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

The primary scenario is to think about taking short positions on dips below the level of 0.9887 with a target range of 0.9350 to 0.9076.

An alternative scenario is that the pair will continue to rise to levels between 1.0056 and 1.0350 with a breakout and consolidation above the level of 0.9887.

Analysis: On the daily chart, the fourth wave of larger degree (4) appears to have finished growing as an ascending corrective, and the fifth wave (5) of 5 began to take shape. On the H4 chart, wave I of 1 has formed inside the first wave of smaller degree 1 of (5). On the H1 chart, wave (c) of iii, the final wave of a local correction that had been developing as wave ii of 1, appears to have formed. 1's wave iii began to develop. If the assumption is accurate, the pair will keep falling to the range of 0.9076 - 0.9350. In this case, the value of 0.9887 is crucial. The pair will be able to continue gaining once it breaks out to levels between 1.0056 and 1.0350.

|

| USDCHF : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| USDCHF : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| USDCHF : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

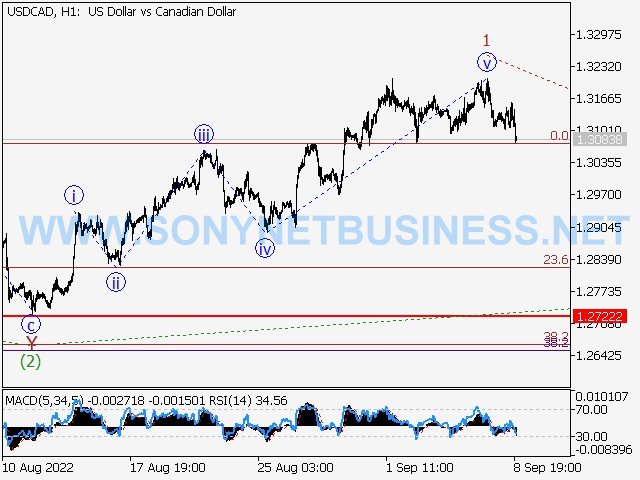

USDCAD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

Main scenario: After the correction is complete, try taking long positions above the level of 1.2722 with a goal of 1.3430 - 1.3708.

An alternative possibility is that the pair will continue to fall to levels between 1.2540 and 1.2409 with a breakout and consolidation below the level of 1.2722.

Analysis: On the daily chart, the fifth wave of bigger degree 5 is likely developing, with waves (1) of 5 having formed and a corrective wave (2) of 5 having finished as its constituents. On the H4 chart, the first wave of the smaller degree 1 of the third wave, the third wave (3) of 5, began to form. As the second wave 2 of (3) on the H1 chart, it appears that a local correction began to take shape. If this supposition is true, the pair will continue to rise after the correction, reaching values between 1.3708 and 1.3430. In this case, the level of 1.2722 is crucial because a break of it would allow the pair to continue falling to the levels of 1.2540 and 1.2409.

|

| USDCAD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| USDCAD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| USDCAD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

WTI Crude Oil : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

The primary scenario is to think about taking short positions from corrections below the level of 98.29 with a target range of 69.28 to 54.60.

An alternative scenario is that the asset will continue to rise to levels between 115.90 and 131.65 after breaking out and consolidating above the level of 98.29.

Analysis: The daily chart appears to have created the first wave of greater degree (1), and the second wave, a downside correction, is currently developing (2). On the H4 chart, waves A and B of (2) appear to have developed, while wave C of (2) has begun to take shape. On the H1 chart, it appears that wave (iii) of I the first counter-trend wave of smaller degree I of C, is developing. If the assumption is accurate, the price will keep dropping until it reaches the range of 69.28 to 54.60. In this scenario, the level of 98.29 is crucial since a breach there would allow for further price growth to levels between 115.90 and 131.65.

|

| WTI Crude Oil : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| WTI Crude Oil : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| WTI Crude Oil : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

XAUUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022

The primary scenario is to think about taking long positions from corrections above the level of 1688.36 with a target range of 1879.10 to 1997.97.

An alternative possibility is that the pair will continue to fall to levels between 1650.00 and 1601.03 after breaking through and consolidating below the level of 1688.36.

Analysis: On the daily chart, wave C of wave (4) has been completed inside what appears to be a downward corrective as the fourth wave (4) of larger degree. On the H4 chart, the fifth wave (5), which includes the first counter-trend wave of smaller degree I of 1 of (5) completed as its component, looks to be forming. On the H1 chart, a local correction that had been the second wave ii of wave 1 ended forming, and wave I of wave 1 began to form as its third wave iii. The pair will increase to the levels of 1879.10 - 1997.97 if the assumption is accurate. In this situation, the level of 1688.36 is crucial since a breach of it will allow the pair to continue falling to the levels of 1650.00 - 1601.03.

|

| XAUUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| XAUUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

|

| XAUUSD : Elliott wave analysis and forecast for 09.09.2022 – 16.09.2022 |

.png)

.png)