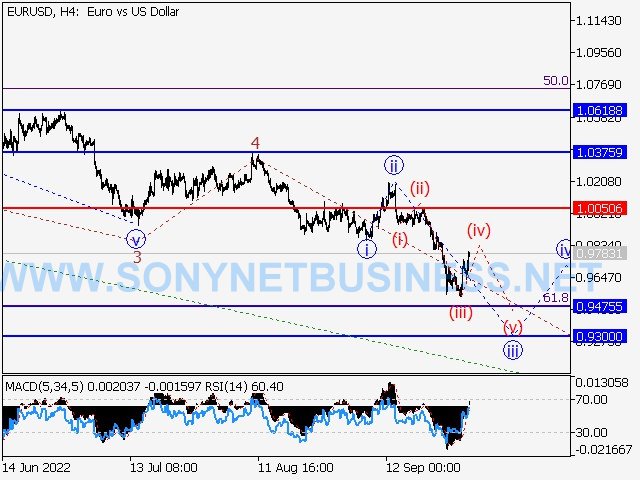

EURUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

With a target of 0.9475 to 0.9300, try taking short positions on dips below the level of 1.0050.

An alternative scenario is that the pair will continue to rise to the levels of 1.0375–1.0618 if it breaks out and consolidates above the level of 1.0050.

Analysis: A larger-degree descending wave A should be taking shape in the daily timeframe, with wave (5) of developing inside. In the H4 timeframe, wave 5 of (5) must be forming, with wave a iii of 5 developing inside. The local correction is forming as the fourth wave (iv) of a lower degree of iii in the hourly chart, which indicates that the smaller degree's third wave (iii) of iii must have finished. If the assumption is accurate, the pair will keep falling until it reaches values between 0.9475 and 0.9300. In this case, the level of 1.0050 is crucial. The pair will be able to continue climbing once it breaks out to levels between 1.0375 and 1.0618.

|

| EURUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| EURUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| EURUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

GBPUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

Main scenario: After the correction is through, think about taking short positions with a goal of 1.0300–1.00000 below the level of 1.1737.

An alternative scenario is that the pair will continue to rise to levels between 1.2280 and 1.2665 if it breaks out and consolidates above the level of 1.1737.

Analysis: Wave (3) of V is forming as the fifth wave of bigger degree V, which is likely developing on the daily chart. On the H4 chart, the fifth wave of smaller degree 5 of (1) is taking shape, with wave iii of 5 having finished inside. The local correction as the fourth wave iv of 5 must be developing in the hourly time frame, with wave (c) of iv unfolding inside. If the assumption is accurate, the pair will keep falling until it reaches levels between 1.0300 and 1.0000 when the correction is through. In this scenario, the level of 1.1737 is crucial since a breach there would allow the pair to continue advancing to levels between 1.2280 and 1.2665.

|

| GBPUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| GBPUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| GBPUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

USDCHF : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

The main scenario is to think about taking long positions from corrections above level 0.9478 with a target of 1.0056 to 1.0200.

An alternative possibility is that the pair will continue sliding to the levels of 0.9200 - 0.9073 with a breakout and consolidation below the level of 0.9478.

Analysis: In the daily timeframe, a downward corrective has ended as the second wave (2) of a larger wave, and wave 3 of wave (3) is forming inside the third wave. The fourth wave iv of wave 3 of a reduced degree, which represents the local correction, has concluded on the four-hour chart, and wave 5 of wave 3 is still developing. Wave (iii) of iii is growing in the H1 period, with local correction finished inside as waves (iv) and (v) of (iii) are beginning to form. The pair will continue to rise, maybe reaching levels between 1.0056 and 1.0200 if the assumption is right. In this case, the value of 0.9478 is crucial. If it breaks out, the pair will be free to keep declining until it reaches levels between 0.9073 and 0.9200.

|

| USDCHF : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| USDCHF : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| USDCHF : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

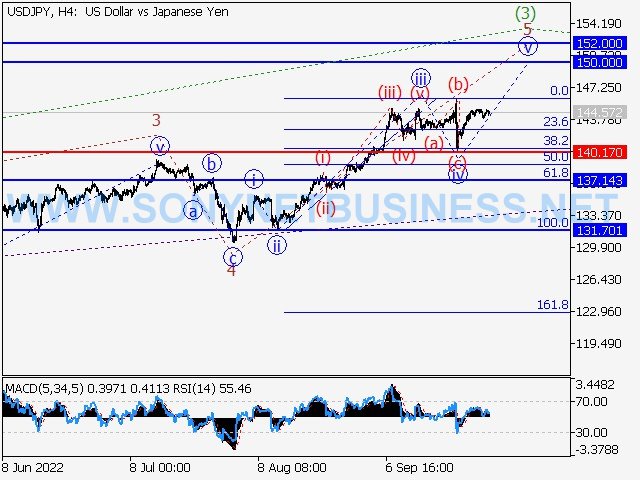

USDJPY : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

With a target of 150.00 to 152.00, try taking long positions on corrections over the level of 140.17.

An alternative scenario is that the pair will continue to decline to levels between 137.14 and 131.70 with a breakout and consolidation below the level of 140.17.

Analysis: Wave 3 of (3) was produced as the upward third wave of larger degree (3), which is still developing on the daily chart. On the H4 chart, the fourth wave 4 of (3) has finished forming, and the fifth wave 5 of (3) is still developing. On the H1 chart, it appears that the third wave of smaller degree iii of 5, which is the development of the local correction as the fourth wave iv of 5, has finished, has formed. The fifth wave is beginning. If the assumption is accurate, the pair will increase further to between 150.00 and 152.00. In this scenario, the level of 140.17 is crucial since a breakout would allow the pair to keep falling to the levels of 137.14 and 131.70.

USDCAD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

The main scenario is to think about taking long positions from corrections over 1.3492 with a goal of 1.4050 to 1.4300.

An alternative scenario is that the pair will continue to decline to levels between 1.3287 and 1.2951 if it breaks out and consolidates below the level of 1.3492.

Analysis: Wave (1) of 5 was formed, and a corrective wave (2) of 5 was finished, thus it is likely that the fifth wave of larger degree 5 is currently developing on the daily chart. Waves 1 and 2 of the 5's third wave (3) have finished, while wave 3 of wave (3) is currently building in the H4 timeframe. With wave (iv) of iii completed and wave (v) of iii developing inside, wave iii of 3 is evolving in the hourly period. If the assumption is accurate, the pair will keep increasing until it reaches levels between 1.4050 and 1.4300. In this case, 1.3492 serves as the pivot level because a breach of this level would allow the pair to continue falling to levels between 1.3287 and 1.2951.

|

| USDCAD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| USDCAD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| USDCAD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

XAUUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

The primary scenario is to think about taking short positions from corrections below the level of 1734.53 with a target range of 1570.70 to 1491.84.

An alternative scenario is that the pair will continue to rise to levels between 1809.33 and 1879.10 after breaking out and consolidating above the level of 1734.53.

Analysis: On the daily chart, a bearish correction is apparently still in progress as the fourth wave of a bigger degree (4), with wave C of (4) continuing to develop inside. On the H4 chart, the fifth wave of a smaller degree (v) of iii of C is reportedly forming inside the third wave iii of C. On the H1 chart, wave iii of (v) of iii has finished, and wave iv of (v) of iii is forming locally (v). If the assumption is right, the pair will keep falling until it reaches 1570.70 - 1491.84 when it is finished. In this case, the level of 1734.53 is crucial since a breach there would allow the pair to continue climbing to levels between 1809.33 and 1879.10.

|

| XAUUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| XAUUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| XAUUSD : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

USCRUDE : Elliott wave analysis and forecast for 30.09.22 – 07.10.22

The primary scenario is to think about taking short positions from corrections below the level of 90.40 with a target range of 69.28 to 54.60.

An alternative scenario is that the asset will continue to rise to levels between 98.30 and 103.65 after breaking out and consolidating above the level of 90.40.

On the daily chart, the first wave of greater degree (1) is likely to have developed, and the second wave, a downside correction, is developing (2). On the H4 chart, waves (2) A and (2) B appear to be forming. The third wave of the smaller degree iii of C of wave (2), which is now developing, has created. A local correction is forming as the fourth wave iv of C on the H1 chart. If the assumption is right, the price will continue to decline to between 69.28 and 54.60 after it is finished. In this scenario, the level of 90.40 is crucial since a breach there would allow for further price growth to levels between 98.30 and 103.65.

|

| USCRUDE : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| USCRUDE : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

|

| USCRUDE : Elliott wave analysis and forecast for 30.09.22 – 07.10.22 |

.png)

.png)