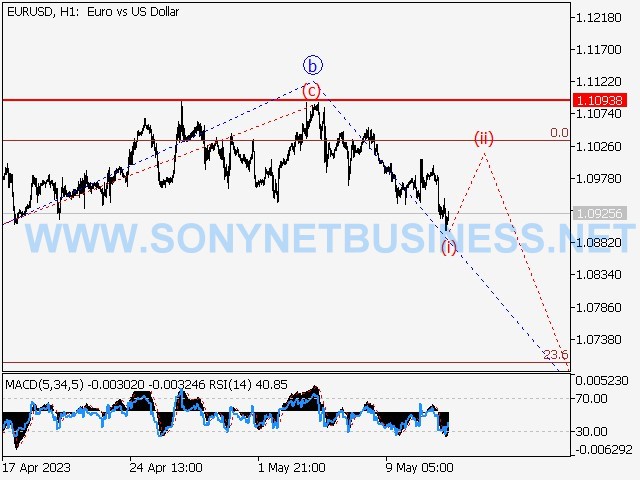

The primary scenario is to think about taking short positions on dips below the level of 1.1093 with a target of 1.0500 to 1.0334.

An alternative scenario is that the pair will continue to rise to levels between 1.1300 and 1.1500 if it breaks out and consolidates above the level of 1.1093.

Analysis : On the daily chart, a bearish wave of greater degree A is likely complete, with the fifth wave (5) of A forming as a part of it. A bullish wave B began to form. The first counter-trend wave 1 of (A) of (B) appears to have finished forming on the H4 chart, and a correction is now reportedly unfolding as second wave 2 of (A) of (B), with wave c of 2 forming as a component. On the H1 chart, the first wave of smaller degree (i) of c is produced. If this presumption is true, when corrective wave (ii) of c is finished, the pair will continue to decline to 1.0500 - 1.0334. In this case, the level of 1.1093 is crucial. The pair will be able to continue gaining after its breakout to levels between 1.1300 and 1.1500.

|

| EURUSD : Elliott wave analysis and forecast for 15.05.23–19.05.23 |

|

| EURUSD : Elliott wave analysis and forecast for 15.05.23–19.05.23 |

|

| EURUSD : Elliott wave analysis and forecast for 15.05.23–19.05.23 |

.png)

.png)