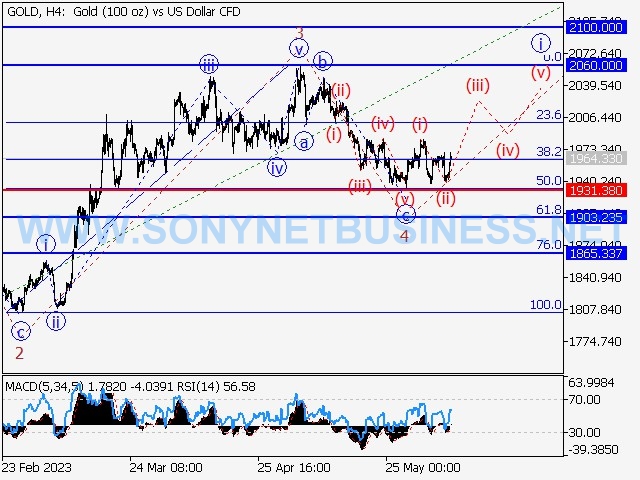

The primary scenario is to think about initiating long positions on corrections over the level of 1931.38 with a target of 2060.00 to 2100.00.

An alternative scenario is that the pair will continue to decline to the levels of 1903.23 and 1865.33 after breaking out and consolidating below the level of 1931.38.

Analysis: On the daily chart, the fourth wave of greater degree (4) of a downward correction is likely complete, and the fifth wave (5) is currently forming. On the H4 chart, it appears as though the third wave of smaller degree 3 of (5) is formed, and a local correction is finished as the fourth wave 4 of (5). On the H1 chart, wave i of 5 was forming as the fifth wave 5 of (5) began to take shape. If the assumption is accurate, the pair will increase to levels between 206.00 and 2100.00. In this scenario, the level of 1931.38 is crucial since a break of it would allow the pair to continue falling to the levels of 1903.23 and 1865.33.

|

| XAUUSD : Elliott wave analysis and forecast for 09.06.23–16.06.23 |

|

| XAUUSD : Elliott wave analysis and forecast for 09.06.23–16.06.23 |

|

| XAUUSD : Elliott wave analysis and forecast for 09.06.23–16.06.23 |

.png)

.png)