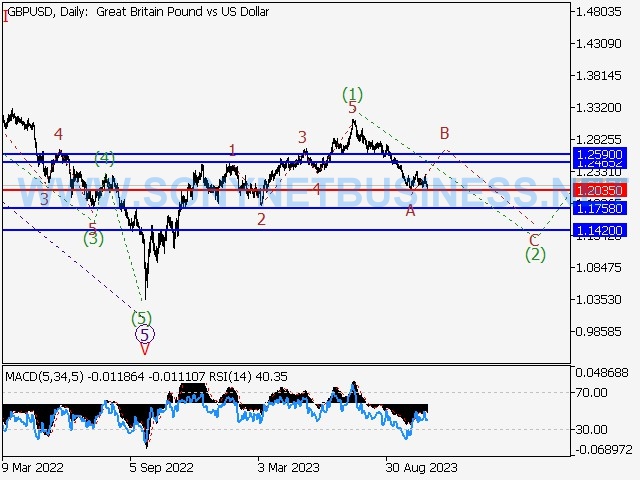

EURUSD : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

The primary course of action is to take long positions from corrections above 1.0446, with a target range of 1.0765 to 1.0858.

As an alternative, the pair might continue to drop to the levels of 1.0256 and 1.0100 if there is a breakthrough and consolidation below the level of 1.0446.

Analysis: On the daily chart, a bearish wave of greater degree A is most likely finished. The first counter-trend wave 1 of (A) of B formed, marking the beginning of a bullish wave B. On the H4 chart, wave а of 2 of (A) has developed, and a local correction is developing as wave b of 2, suggesting that a downside correction is likely to occur as the second wave 2 of (A) of B. Wave (b) of b is now developing, while wave (a) of b is most likely formed in the H1 time frame. If the assumption is right, the pair will rise further in wave (c) of b to levels between 1.0765 and 1.0858 following the formation of wave (b) of b. In this case, the level of 1.0446 is crucial. The pair will be able to continue dropping to the levels of 1.0256 – 1.0100 following its breakthrough.

|

| EURUSD : Elliott wave analysis and forecast for 27.10.23 – 03.11.23 |

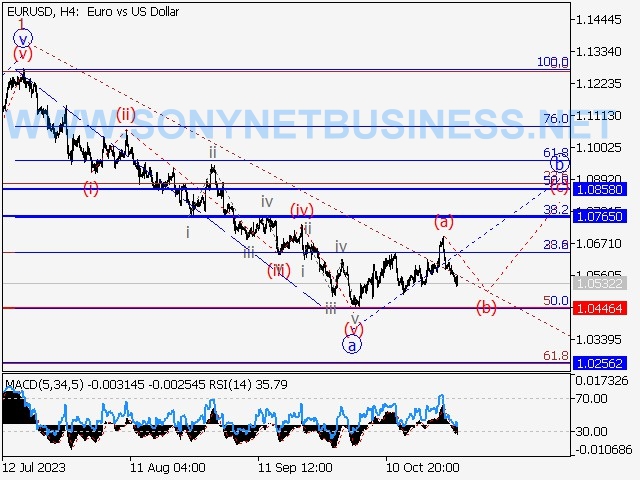

USDCHF : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

The primary course of action is to take short positions from corrections below the 0.9242 level, with a target range of 0.8807 to 0.8706.

Option 2: The pair can continue climbing to the levels of 0.9352 – 0.9540 if it breaks out and consolidates above the level of 0.9242.

Analysis: wave 1 of bigger degree (5) occurred as part of the downside fifth wave, which is likely developing on the daily time frame. As wave 2 of 5, a bullish corrective is presently taking place.

On the H4 time frame, a wave of smaller degree, wave an of 2, is generated, and wave b of 2, a descending corrective, is developing. Wave (a) of b appears to have originated on the H1 time frame, while wave (b) of b is a local correction that is emerging. If this assumption is accurate, after the correction is finished, the pair will drop further in wave (c) of b to the levels of 0.8807 – 0.8706. In this case, the level of 0.9242 is crucial. The pair will be able to move higher to the levels of 0.9352 – 0.9540 after it breaks out.

|

| USDCHF : Elliott wave analysis and forecast for 27.10.23 – 03.11.23 |

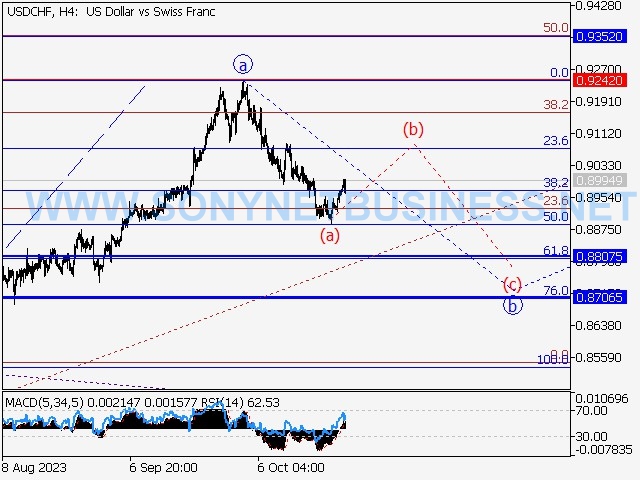

GBPUSD : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

Primary scenario: Take into account long positions from corrections above 1.2035, with a target range of 1.2465 to 1.2590.

Option 2: The pair can continue falling to the ranges of 1.1758–1.1420 if there is a breakout and consolidation below the level of 1.2035.

Analysis: On the daily chart, the first wave of larger degree (1) is most likely formed, and the second wave (2) represents the beginning of a negative correction. The H4 time frame is when wave ΐ of (2) forms, and wave B of (2) represents the beginning of a bullish correction. Wave B appears to be developed in the H1 time frame, and wave B is most likely finished. Assuming the assumption is accurate, the pair will rise to levels between 1.2465 and 1.2590 in wave c of B. In this case, the level of 1.2035 is crucial because a breakout there would allow the pair to continue dropping, reaching levels between 1.1758 and 1.1420.

|

| GBPUSD : Elliott wave analysis and forecast for 27.10.23 – 03.11.23 |

USDJPY : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

The primary course of action is to take long positions from corrections over 148.65, with a target range of 152.50 to 155.00.

As an alternative, the pair could continue to drop to the levels of 147.14 to 144.36 if there is a breakthrough and consolidation below the level of 148.65.

Analysis: On the daily chart, a larger degree C ascending wave is still forming, and the fifth wave (5) of C is now unfolding as part of it. Wave 3 of (5) is emerging on the H4 chart, and wave v of 3 is developing as part of it. With wave iii of (v) completed, a local correction created as wave iv of (v), and wave v of (v) continuing to unfold, the fifth wave of smaller degree (v) of v of 3 appears to be continuing growing on the H1 chart. Assuming the assumption is accurate, the pair will go up to levels between 155.00 and 152.50. In this scenario, the level of 148.65 is crucial because a breakout would allow the pair to continue falling to the levels of 147.14 - 144.36.

|

| USDJPY : Elliott wave analysis and forecast for 30.10.23 – 03.11.23 |

USDCAD : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

Default position: Take long positions from corrections over 1.3658, aiming for 1.4100–1.4300.

Option 2: The pair can continue falling to the levels of 1.3412 – 1.3090 if there is a breakout and consolidation below the level of 1.3658.

Analysis: On the daily time frame, the bullish first wave of greater degree (1) is probably developing, with the fifth wave 5 of (1) forming as a component of it. On the H4 chart, wave (iii) of iii is forming as part of the third wave of the smaller degree iii of 5. Wave iii of (iii) appears to be evolving on the H1 time period. The pair will continue to rise to 1.4100–1.4300 if this assumption is true. In this case, the breakthrough of the level 1.3658 is crucial because it will allow the pair to continue falling and reach the levels of 1.3412 – 1.3090.

|

| USDCAD : Elliott wave analysis and forecast for 30.10.23 – 03.11.23 |

WTI Crude Oil : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

Primary scenario: Take into account short positions from corrections below 91.20, with an objective of 80.00 – 76.36.

As an alternative, the asset may continue to rise to levels between 95.65 and 100.00 if it breaks out and consolidates above 91.20.

Analysis: On the daily chart, the first wave of larger degree (1) is likely created, the second wave (2) developed as a downward corrective, and the third wave (3) began to unfold. On the H4 chart, the first wave of smaller degree 1 of (3) is most likely developing. Wave iv of 1 is forming as a downward correction, while wave iii of 1 has formed. On the H1 chart, wave (c) of iv appears to be forming. The asset's price will continue to decline to 80.00 – 76.36 if this estimate is accurate. In this case, a breakout over 91.20 is crucial because it will allow the price to continue climbing and reach levels between 95.65 and 100.00.

|

| WTI Crude Oil : Elliott wave analysis and forecast for 30.10.23 – 03.11.23 |

XAUUSD : Elliott wave analysis and forecast for 30.10.23 – 03.11.23

The primary course of action is to take long positions from corrections over 1950.36, with a target range of 2023.50 to 2060.00.

A different course of events could see the pair continue to drop to the levels of 1903.00 to 1881.60 if there is a breakout and consolidation below 1950.36.

Analysis: On the daily chart, a downward corrective seems to have formed as the fourth wave (4) of larger degree. Wave 1 of wave 5 has created and is part of the unfolding of wave 5. It appears that wave c of wave 2 completed a downside correction that formed as second wave 2 of (5) on the H4 time frame. On the H1 time frame, wave 3 of (5) began to form, and as its component, the first counter-trend wave of smaller degree I of 3 continued to build. The pair will continue to increase to the levels of 2023.50 – 2060.00 if the assumption is accurate. In this case, a breakout over 1950.36 will allow the pair to continue falling, reaching levels between 1903.00 and 1881.60.

|

| XAUUSD : Elliott wave analysis and forecast for 30.10.23 – 03.11.23 |

.png)

.png)