|

| Everything You Need to Know About ECN Trading |

Everything You Need to Know About ECN Trading.

The Forex market has evolved significantly since its inception, and it is no longer the same market it once was. Every year, trading technologies improve, and brokers aim to give the finest quality services to their clients by regularly upgrading the system's capabilities. One of the most significant changes in the modern Forex market is the ECN account. This article will explain what ECN trading is, who an ECN broker is, and why traders should choose an ECN account. Let's look at why ECN trading is the safest way to trade in the Forex market, as well as its benefits and drawbacks.

What is ECN (Electronic Communication Network) and how does it work? Meaning & Definition.

What is the meaning of ECN? To answer this frequently asked question, the ECN abbreviation - Electronic Communication Network – will be helpful.

ECN is an electronic system for the buying and selling of exchange commodities (currencies, raw materials, etc.) that was established to eliminate intermediaries, according to the official definition. The Forex ECN system was created to connect individual traders with large brokers without the use of a middleman.

The ECN system's main idea is that the client's order (trade) is sent directly to the market, and its volume may even impact the exchange rate.

ECN networks can be thought of as a massive universal database of customer requests where similar (compensated) orders can be performed automatically without the intervention of a broker.

Who is this ECN Broker?

Many people today wonder what an ECN broker is and what an ECN account in Forex is. On the Internet, I believe you will frequently encounter numerous brokers offering ECN trades. However, it is a waste of time and money to begin trading ECN Forex without first understanding how it works. As a result, traders should first learn the fundamentals of this relatively new method.

It is not enough to establish a trading account with any Forex broker to be able to trade using ECN technology. The ECN network can only be accessed through a certain ECN Forex broker that uses ndd (no dealing desk) technology. It's also worth mentioning that an ECN account isn't the same as a traditional account. But first and foremost, let's talk about the basics.

An ECN broker is a financial market participant whose primary goal is to aggregate all orders and quotations from all trading participants in order to deliver the best trading conditions to their clients.

In simple terms, an ECN broker is a middleman who connects your application to the ECN market, or overall system of transactions, where the optimal execution price for your transaction can be found.

The ECN system is a network that connects the largest trading players (liquidity providers), including Barclays, JP Morgan, Merrill Lynch, Deutsche Bank, Nasdaq, and others. The ECN broker connects its clients with various liquidity sources, ensuring that the spreads are kept to a minimum.

ECN: Can you explain how it works?

I believe that everyone realises that ECN trading is profitable. But how does it operate in practise, and what exactly is ECN? Let's see what we can do.

|

| Everything You Need to Know About ECN Trading |

ECN: Can you explain how it works?

I believe that everyone realises that ECN trading is profitable. But how does it operate in practise, and what exactly is ECN? Let's see what we can do.

This mechanism works in the following manner:

Banks (liquidity providers) access the ECN system and submit their BID and ASK pricing bids;

ECN brokers access this server for quotes, which they then send to their clients' trading terminals, the most common of which are MT4 and MT5.

The client receives prices and decides whether or not to proceed with the purchase.

The client submits a request to the broker, who automatically shows it on the ECN server and compares it to liquidity provider and other ECN broker offers.

A client, for example, wants to purchase the EUR/USD currency pair at the current market price. There are three sell offers in the system: 1.1607, 1.1608 and 1.1609. Orders are processed at the best price in this scenario, and your transaction is completed at 1.1607.

That is all there is to it. There is practically no spread because transactions are carried out at the most advantageous price for the trader, making ECN trading the most profitable at the present.

STP vs. ECN

The international financial market is continually evolving, and more modern methods such as STP and ECN are gradually replacing traditional client-broker interaction mechanisms.

STP and ECN are the two most popular trading systems in the Forex market, and while they are fairly similar, there are some key differences.

Straight Through Processing (STP) is an acronym for "straight through processing." This form of processing entails a direct transfer of your order to a liquidity provider who is a broker's partner. This partner could be the largest bank or a group of banks. The better your broker's direct partners are, the better your order's final execution price will be.

Electronic Communication Network (ECN) is a term that refers to a network that allows people to communicate It differs from STP in that the client's order is not directly published on the interbank market, where all system participants can view it and decide whether or not to execute it after estimating the volume.

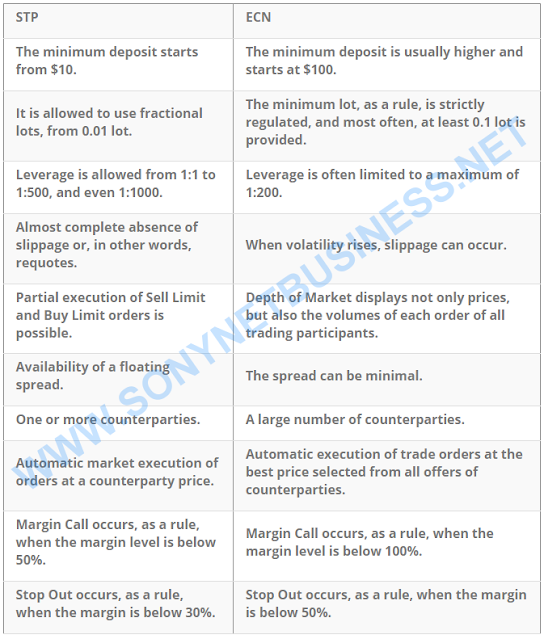

These systems are extremely similar, as you can see from the definitions. The following table shows the distinctions between them:

|

| Everything You Need to Know About ECN Trading |

Of course, these aren't the only differences between these two sorts of accounts, but I believe they're sufficient to understand the differences between them.

Other types of order execution, such as mm, dma, and mtf, exist in addition to STP and ECN systems.

In the article "Forex Broker Types," you can learn more about each type of broker and their working principles. A-Book and B-Book" are two different types of books.

Benefits of an ECN Forex Broker.

As I previously stated, choosing an ECN broker is one of the best moves a trader can make before entering the Forex market. To sum up everything I've discussed, I'd want to emphasise the advantages that traders can receive by working with an ECN broker.

From the most significant to the minor, I've developed a list of advantages.

Spreads are extremely tight.

The discrepancy between the Bid and Ask prices creates spreads in the Forex market. In the ECN Forex system, all players compete for the execution of orders, attempting to give the best terms. During the execution process, the most cost-effective price is picked, and during active trading in the European and US trading sessions, there may be no spread at all. All traders, on the other hand, desire to make money. Forex ECN brokers, like everyone else, want to make money, so they generally set the minimum spread size at 0.1 to 0.2 points.

Brokers are prohibited from interfering with the bidding process.

An ECN broker is a simple intermediary who searches the system for the best application for you and issues it to you, charging a commission. Due to a lack of access to trades and pricing, the broker is powerless to affect them. During the entire trading procedure, clients of such brokers are guaranteed to obtain correct price data in real time.

Orders are executed at a breakneck pace.

The ECN system's Market Execution order execution type removes any delays. When working with the earliest electronic brokers, the terminal would often process your order for a few seconds before reporting that the market price had changed and the transaction could not be completed. Such a situation is impossible under the ECN system because transaction execution times range from 20 to 80 milliseconds. The ECN system is popular among algorithmic traders because of this. Even ECN stock trading has progressed tremendously, despite the fact that getting stocks is more difficult than acquiring currency.

Placing pending orders is subject to the following restrictions.

Trading with pending orders is becoming increasingly common, as most trading robots and algorithmic scripts are built around them. The ECN method allows you to place pending orders as near to the market price as feasible. There are even instances where a pending order can be placed between the Bid and Ask prices, which would be impossible with any other broker. As a result, traders have access to nearly infinite trading opportunities.

Software that is specialised.

Aside from the most popular trading terminals, certain ECN brokers have delved so deeply into the system's workings that they attempt to provide their clients with the greatest conditions, software, and equipment available. Stock market brokers, for example, create their own trading terminals or scripts that allow clients to observe counterparties and obtain information on transaction volume in depth of market. A trading platform like Fxall is one example. Such notions like ECN trading in stocks or options are simply impossible without this specialised software.

ECN Forex Brokers Have Disadvantages.

If an ECN broker offers benefits, it must also have drawbacks, which are described below. Let's begin with the most important.

ECN brokers who aren't real.

When traders understood how important electronic communication networks (ECNs) are compared to older systems, numerous dishonest brokers started posing as ECN brokers. Fake ECN broker ratings can be found on a variety of websites. Try searching for "ECN Forex brokers list of the highest rated" and selecting the first company that comes up. Scammers who have purchased a spot in this ranking usually occupy them. As a result, I decided to devote a whole section to the process of selecting a broker, which you can read about below.

High initial deposit requirements are possible.

The trader must realise that the broker is also looking to make money. A commission is the only source of income for an ECN broker. Because the commission is based on volume, having clients with deposits of $10 or $20 makes no sense for a broker. As a result, brokers use the ECN system to set minimum deposit values that range from $100 to $1000. The suggested deposit ranges from $10,000 to $50,000.

Fees for commissions.

Of all, this is scarcely a significant disadvantage because everyone understands what it is for. The commission in the ECN system is based on transaction volume, and it can reach extreme levels with big trading volumes, at which your ECN transactions will still be affordable.

Execution of Market Orders.

The deal enters "into the market" if traders do not use pending orders when trading. This indicates that it will be carried out at the current system pricing. While your order is being processed, the system's price may have changed, and your trade will be completed at the most recent one. This occurs as a result of excessive market volatility. You should not be concerned because the possibilities are exceedingly slim.

How can I know whether I'm dealing with an ECN Broker?

After we've gone over the advantages and disadvantages, we'll move on to the most crucial topic for traders. Let's look at how to select a broker. As I have stated, some dishonest brokers pose as ECN or STP when they are actually kitchens.

The following are the requirements for a good ECN broker:

1. Type of order execution. It's got to be Market Execution! So far, it's been the most effective order execution method. Any other order execution mechanism used by a broker may have an impact on the trading process, which is undesirable.

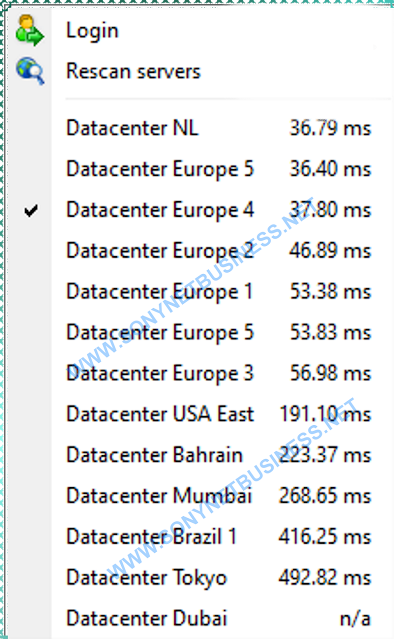

2. The quickness with which orders are executed. If a broker uses the ECN model, order execution speed on distant servers should not be less than 200-300 ms, and order execution speed on near servers should not be less than 100-120 ms. It should be between 40 and 60 milliseconds.

|

| Everything You Need to Know About ECN Trading |

The accompanying screenshot shows the execution speed of my broker, LiteFinance, where I trade using the MetaTrader 4 interface. As you can see, the server closest to my location has a speed of 36.55 milliseconds, which is fairly good.

3. Floating spread that is narrow. For trading high-liquid instruments, any ECN broker offers its clients a floating spread that is near to the minimum.

|

| Everything You Need to Know About ECN Trading |

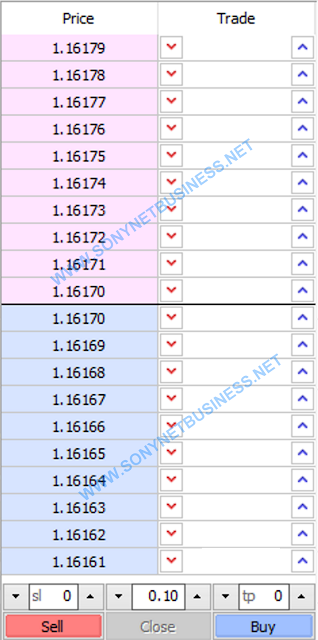

As you can see, the spread for EURUSD trades is not merely a minimum; there is currently no spread at all.

4. Per-trade commissions. Commission fees are the sole source of income for every legitimate ECN broker.

5.The ability to use the spread to put pending orders. The broker should not impose any restrictions on the execution of orders that are simply governed by the ECN system's Bid and Ask pricing.

6. One of the ECN systems is accessible to the Broker. This is an unbreakable rule. If a broker does not offer access to platforms like LavaFX, IntegralFX, instinet, atriax, 360T, or Currenex, you may be confident that your broker does not offer a real ECN account. Through overlapping liquidity suppliers, LiteFinance has such access.

7. Market depth in the trading terminal. The depth of market (DOM) is commonly represented as an electronic list of outstanding buy and sell orders sorted by price level and updated in real time. The graphic for point 3 depicts a Market Depth, which aids in the analysis of the current market scenario.

8. Requirements for a deposit of a certain amount. The ECN is substantially more expensive than other order execution modes for a broker. Because an ECN broker earns commission based on the volume of transactions, accounts with deposits of $10 or $20 are pointless. The broker will simply go bankrupt in this case. As a result, ECN brokers require a substantially greater minimum deposit for ECN accounts than for other types of accounts.

How Are ECN Fees Calculated?

The concept of the broker's commission has already been discussed several times. Let me explain what the ECN commission is and how it is computed in greater detail.

The total of all payments made by ECN systems and ECN brokers for buy and sell transactions is known as the ECN commission.

Simply expressed, the total ECN commission traders pay to the broker for completing transactions accounts for the ECN system's interest as well as the broker's profit from giving ECN network access.

I will try to explain how the commission is charged in simple terms so as not to confuse you with long calculations.

ECN brokers, on the whole, strive to make the concept of commission as simple as possible by charging clients a flat commission every transaction, such as $10 per lot or $15 per transaction.

|

| Everything You Need to Know About ECN Trading |

1st example

The commission calculation formula in this scenario will be as follows:

(fixed commission * trading volume (lots)) = ECN commission.

ECN = ten dollars multiplied by a factor of ten.

This is an example of the commission charged by the LiteFinance broker for a one-lot transaction in any major currency pair.

Example No. 2

Other brokers may charge a percentage of the transaction volume as a commission. The following is the calculating formula in this scenario.

(Commission in percent * trading volume (currency units)) = ECN commission.

ECN commission = 4.5 EUR + 4.5 USD = (4.5 EUR * 1.1600) + 4.5 USD = 9.72 USD = (0.0045 percent * 100 000 EUR) + (0.0045 percent * 100 000 USD) = 4.5 EUR + 4.5 USD = 4.5 EUR + 4.5 USD = 4.5 EUR + 4.5 USD = 4.5 EUR + 4.5 USD = 4.5 EUR + 4.5 USD = 4.5 EUR + 4.5 USD = 4.5 EUR + 4.5 USD =

The final result is nearly identical to the last example, but the mathematical process is a little more complicated.

You should be aware that a commission is always applied to a complete transaction, such as a purchase and subsequent sell. In the first instance, the broker factored this into a single figure. In the second case, we simply added the purchase and sale commissions together.

Even if you understand how the commission is determined, you may be wondering where the broker receives this figure. Why exactly ten dollars or 0.0045% of a percent?

To comprehend this, you must first comprehend where the commission comes from. As previously stated, ECN commission equals (ECN system commission + ECN broker commission).

I hope the broker commission is clear; it is a fee that the broker charges for providing the client with direct access to other participants in the electronic communications network through its intermediary services. Let's take a closer look at the ECN system's setup.

As a result, the ECN system has a significant edge over all others in terms of liquidity. In the realm of finance, liquidity is a value that describes a product's capacity to be sold or bought rapidly. In other words, the quality of the exchange market is determined by liquidity.

Allow me to explain the concept of liquidity. Let's compare and contrast the grocery and forex markets. If you need to purchase a product or money right away, there should be a seller willing to sell it to you in the market.

When you go to the market to buy some meat, for example, you look at the pricing and realise that no one sells meat for the price you want. This indicates that there is currently no or extremely limited liquidity for the desired product. And if you want to buy a currency pair on the Forex market, you may do so in a fraction of a second because there are many sellers willing to sell at the price you want. This indicates a high level of market liquidity.

But who is responsible for this liquidity? The electronic communications network, mainly institutional investors, provides liquidity. Banks, brokers, funds, trusts, and a variety of other institutions send orders to the network. Trading services are available 24 hours a day, seven days a week through the electronic communication network, and it is only right that these services be paid for. As a result, the ECN charges a commission, which is paid for you by your broker, and you are charged a fixed and transparent sum.

Is there usually a commission charged by the ECN? No, it is not always the case. As long as the ECN system is monitoring the maintenance of liquidity, everyone who adds liquidity to the market is rewarded, while those who withdraw liquidity from the market are penalised. So, let's look at an example of how it works.

1st example

Let's imagine you wish to place a purchase order in the EUR/USD currency pair with a 1 lot trade volume (100,000 currency units). You wish to purchase the pair right now, on the market. Of course, you place a trade, and your broker enters it into the system, where it is immediately matched by the system's most profitable sell order. In this situation, a volume of 100,000 currency units is taken from the system to open your trade, removing this level of liquidity. You will be charged a commission because you have diminished the system's liquidity.

Example No. 2

Let's imagine you want to buy one lot (100,000 currency units) of EURUSD but not immediately now. In this instance, a pending order, most typically a limit order, would be used. Your trade is entered into the system's list of orders, the Depth of Market, once you place an order with your broker. Because your order hasn't been executed yet, it remains in the system, bringing more liquidity to the market. The ECN system rewards you by not charging you a commission until your order is completed.

To summarise all I've said thus far, I'd like to emphasise that trading without a commission is impossible. It is false to suggest that a broker does not charge a commission since the trade order is placed in the ECN. The commission is not a method of depriving you of your funds; rather, it is a required measure of revenues for a trustworthy broker. Many brokers, on the other hand, offer rebate as a commission refund alternative to their clients.

Why should you consider using an ECN broker?

Returning to the trading mode selection, it is clear that ECN or STP are the only options available at this time. ECN trading is becoming increasingly popular among traders.

What are the benefits of dealing with an ECN broker?

1. The market data is guaranteed to be confidential and reliable.

- Do you understand how quotes can be manipulated? It is an important question for individuals who have been trading for a long period. When trading on the ECN, you can be sure that the quotes you receive are accurate.

- The Depth of Market feature on ECN allows you to see the orders placed by all network members at any time.

2. A float spread is a type of spread that floats in the air.

- The ECN spread is a floating spread that fluctuates with market volatility.

- Popular trading instruments with minimal volatility may have a zero spread.

3. Orders are processed immediately.

- If you enter a transaction at market pricing, you may rest assured that your order will be filled immediately and without delay.

- The finest ECN brokers offer order execution times of less than 50 milliseconds.

4. The counterparty is visible.

- In the ECN, you can always see who matches your order and purchases your currency or merchandise.

- In the Depth of Market, you can observe the current transaction volume in the market.

5. You can use trading robots or trade on the news.

- Because the ECN has such high liquidity, you can place pending orders within the spread and react quickly to price changes.

- ECN accounts are ideal for traders that use the ATS or unique scripts to trade.

- I recognised all of these benefits of trading using an ECN broker many years ago, and my preferred brokerage firm is still LiteFinance. Many other reputable ECN brokers have appeared since then, but I stay dedicated to LiteFinance, one of the largest Forex brokers, for its transparent trading conditions and reasonable costs.

Summary of ECN Trading.

ECN trading, in my opinion, has revolutionised the Forex industry. A trader could never have predicted that the role of a broker and other intermediaries would be fully abolished, allowing for fair and transparent trading. ECN accounts are a straightforward and convenient way to gain access to the interbank market while maintaining the highest standard of service. ECN accounts are essential for profitable trading since they have the tightest spreads and transparent commissions. There are a lot of ECN brokers out there. It is critical to find a dependable and trustworthy broker who is loyal to its clients if you want to succeed in trading and make money.

.png)

.png)