|

| Best Forex Stop Loss Strategies |

All profit opportunities in global markets come with some level of risk, and the Forex market is no exception.

Stop-loss orders are one of the most effective and extensively utilised methods for keeping hazards under control and limiting risks. Stop-losses are an important aspect of any well-rounded risk management strategy, and they should be thoroughly understood even before you place your first trade.

The most common mistake beginning traders make in the markets is underestimating risks and collecting losses. We'll show you how to use a basic instrument called stop-loss orders to keep an eye on your risks and reduce losses when everything goes wrong.

What Is a Stop-Loss and Why Do You Need One?

In the trading community, there is a saying that 90% of traders lose 90% of their trading capital in 90 days. While there are many elements that contribute to successful trading, this statistic could have been considerably higher if novice traders employed stop-loss orders effectively as part of a well-designed trading plan.

So, what precisely is a stop-loss? A stop-loss order is a pending order that automatically quits a trade when the market goes against it, selling a long position or buying back a short position when the market turns against it. When the market reaches a pre-specified price level, commonly known as the stop-loss level, a stop-loss order becomes a market order.

This assists traders in avoiding unexpected losses during periods of increased volatility or while they are not in front of their trading platform. Furthermore, by simply allowing the position to operate, a stop-loss order combined with a take-profit order can minimise any additional work associated with a trade.

What are Stop-Loss Orders and How Do They Work?

Stop-loss orders, in essence, are buy and sell stop orders that are executed when the market reaches a pre-determined threshold. Stop-losses sell your position if you're long, and vice versa.

When applied to a short position, a stop-loss order always follows the ask rate, and when used to a long position, it always follows the bid rate. If you're long EUR/USD at 1.1050/52 and put a stop-loss order at 1.1020, for example, the stop-loss order will only be triggered if the bid rate exceeds that level.

During periods of strong market volatility, such as when major market reports are released, market imbalances can cause slippage and widening of spreads, causing your stop-loss order to be filled at a significantly different price. According to a prominent broker's slippage statistics, nearly 44% of all stop and stop entry orders experienced negative slippage.

Ratios of Reward to Risk

To enhance a trade's risk-to-reward ratio and boost long-term profitability, a stop-loss order should be placed tighter than the potential profit target. Even a middling win rate of 50% can generate considerable gains when R/R ratios are taken into account, as the average profits of a winning position will be higher than the average losses of losing positions.

Stop-Loss Orders: Advantages and Disadvantages

Stop-loss orders are classified into four categories based on how traders determine potential stop-loss levels for a trade: chart stops, volatility stops, time stops, and percentage stops. The guaranteed stop, which will be explored further below, is another popular sort of stop-loss that has recently gained popularity.

Stops on the Graph

The most effective and popular sort of stop-loss is the chart stop. Support and resistance levels, trendlines, channels, moving averages, and chart patterns, to name a few, are all used to create them. The stop is then placed close below/above that level, with the expectation that if it is breached, the current momentum will have shifted, invalidating the trade concept.

In general, a chart stop should be set based on what the chart indicates are critical technical levels, not on how much money a trader can afford to lose. As a result, a stop-loss order should be put at a region where you don't want to continue in the trade if it's breached, allowing for a simple and quick departure.

Keep in mind that wider stop-losses should be utilised to adjust for abrupt price movements in times of significant market volatility. Giving a trade room to breathe reduces the risk of being stopped out by market noise. If you're a shorter-term trader, a stop-loss with a 20-pip leeway will provide you enough room to survive price spikes and frequent changes.

Volatility Has Ended

|

| Volatility Has Ended |

Volatility stops, as the name implies, are based on the present or historical market volatility of the currency pair you're trading. For example, if the GBP/USD pair's average daily volatility is 110 pips, a trader would simply put his stop-loss 110 pips away from the entry price.

The ATR (Average True Range) indicator is a popular indicator that is used in conjunction with volatility stops. Traders that use the ATR to determine average volatility can set a stop loss at 1.5x or 2.0x the ATR value, for example.

Time has come to an end.

Time stops are stop-loss levels that are determined by the passage of time. They're especially popular among day traders who don't want to wait until the closing bells in London or New York, for example, to close their trades.

A time stop is also used when a trader wants to close the trade before the end of the trading day. A swing trader's open positions must be closed before the conclusion of the trading week on Friday, which is also a time stop. In Forex trading, time stops are quite common and are frequently paired with other forms of stop-losses.

Stops by Percentage

A percentage stop is just a stop-loss based on a trading account's percentage. Unlike chart stops, percentage stops are simply put at a level that, if struck, restricts losses to a pre-specified proportion of the trading account.

Keep in mind that percentage stops have nothing to do with position sizing, which is a typical trading tactic. Traders are usually better off employing chart stops and sizing their positions to risk only a small percentage of their trading funds rather than using percentage stops. The size of your position should be determined by the distance between your stop-loss and your entry point, not the other way around!

Stops that are guaranteed

Last but not least, guaranteed stops are stops that ensure that a position will be closed whenever the market reaches a pre-determined price level. Remember how we talked about slippage and spread widening? By ignoring underlying market conditions, guaranteed stops totally eliminate those risks.

Guaranteed stops normally come with a little cost called the GSLO (guaranteed stop-loss order) premium because your broker assumes the liquidity and slippage risks. The cost is derived by multiplying your position size by the GSLO premium (as displayed on your broker's website). It's also worth noting that not all brokers provide guaranteed stops.

Which is Better: Static or Dynamic Stop?

Stops can be divided into static and dynamic stops, in addition to the four major categories of stop-losses outlined above.

Stops that are not dynamic

A static stop is just that: it's static. They stay at their current level until the stop is activated or you manually close your position.

Keep in mind that, depending on your trading style and technique, any form of stop-loss might be static or dynamic. A chart stop can be kept at its original price level or adjusted to accommodate changing market conditions (e.g. to a new support or resistance level.) Similarly, a volatility stop can be set at a currency pair's average weekly volatility or moved every day if the daily volatility is employed.

The possible gain must be considered while putting a static stop. To get the most out of your average win rate over time, the risk-to-reward ratio should be at least 1:1 or higher. According to a study conducted by a major Forex broker, traders who utilise a reward-to-risk ratio of at least 1:1 (i.e. risking $1 to make $1) are three times more likely to make a profit than those who do not follow this rule!

Chasing the Flux with Dynamic Stops

A dynamic stop-loss order is based on an indicator such as a moving average or a volatility indicator to eliminate any guessing from the decision and identify when the trading idea becomes invalidated. A dynamic halt, as its name implies, is not a static stop. It fluctuates in response to market conditions and the underlying indication to which it is linked.

Simple and exponential moving averages, such as the 100-period and 200-period EMAs, are popular indicator sets for dynamic stops. The 200-day EMA is particularly important since it is followed by a huge number of traders who base their trading decisions on it. The 200-day EMA (or any other longer-term MA) is frequently employed as dynamic support or resistance, so keep an eye on the market as it approaches one of those MAs.

The Techniques of Trailing Stops

|

| The Techniques of Trailing Stops |

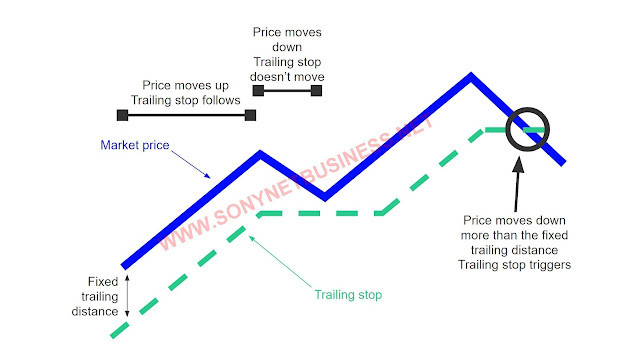

Trailing stops are a form of dynamic stop-loss order that automatically moves your stop-loss with each new price tick in your favour. They enable you to stay in a transaction for as long as possible while extracting as much profit as the market allows.

Trailing stops adjust your stop-loss automatically with each new price tick, but they ignore technical levels or new support and resistance levels along the way. As a result, some traders may find it advantageous to manually move their stops. You might move your stop and lock in profits by placing it at a new swing high or swing low, depending on your trading plan.

Manually Trailing the Stop

Profits can be carefully locked in as the position moves closer to the profit target by manually following your stop. Depending on whether a long or short position is taken, this is normally accomplished by moving the stop loss below the next minor region of support or resistance.

While manually trailing a stop decreases a trader's risk, if the strategy is taken too aggressively, it might result in the stop being hit prematurely. As a result, this approach is best used when the trader is confident that a move below the predetermined stop-loss level, such as below a prior swing high in a long position, will significantly reduce the trade's profit potential.

Additionally, this approach can be used to let profits continue until the stop is reached, which can result in a large profit if the market's momentum lasts longer than expected.

Moving the stop-loss to break-even after the profit reaches one-third of the profit target is a popular way to manually trail stops. Move the stop-loss to the one-third level when the profit rises towards and over two-thirds of the profit target, and so on. This manner, you may lock in winnings while the deal is active and avoid losing money if the market unexpectedly reverses.

Keep in mind, as with previous tactics, to give the trade adequate breathing room to avoid being stopped out on minor price variations.

Trailing Stops That Work Automatically

Most brokers, on the other hand, offer trailing stops, which move the stop-loss with each up-tick of a winning position. Let's say you set a 50-pip trailing stop in EUR/USD. The trailing stop will automatically move the stop-loss as the position moves in your favour, locking in profits and limiting losses along the way. A one-pip increase in your favour moves the stop-loss one pip in the trade's direction.

Trailing stops are popular in trend-following methods because they continue to trail the stop as long as the trend continues. To avoid being stopped out during market corrections, use a trailing stop with a size equal to the trend's average correction size.

Stop-Losses and Risk-per-Trade are a well-known pair.

When it comes to stop-losses, we can't forget about risk-per-trade. The overall risk you're taking on any single trade, expressed as a percentage of your trading account, is known as risk-per-trade. A risk-per-trade of 1%, for example, suggests that you're risking 1% of your trading capital on that trade.

When trading, a well-defined risk management strategy must take into account the risk-per-trade you'll take. Taking on too much risk, such as risking a substantial portion of your trading account on a single trade, can quickly accumulate losses and wipe out your account. One of the most typical blunders made by newcomers to the market is this.

Let's imagine you're trading with a high risk-per-trade of 10%. A losing streak of five trades in a row, which is not uncommon, would wipe away half of your trading account. You'd need a 100% return to get back to your original trading account size! That's when emotional trading takes over, and you start making foolish trading decisions, overtrading, and blowing out your entire account. Sticking to a prudent risk-per-trade of up to 2%, as recommended by many reputable trading sources, is a simple way to avoid this.

Sizing of the Position

|

| Sizing of the Position |

The maximum position size you can take on a trade is directly influenced by the size of your stop-loss order — the tighter the stop, the larger the position, and vice versa. Position sizing and the concepts of risk-per-trade and chart stops have a lot in common.

Here's an example of how to calculate your position the smart way by employing a chart stop and sticking to a risk-per-trade limit.

Assume you wish to buy EUR/USD at 1.1050 with a stop-loss just below the current support level of 1.1010. This is a chart stop, which means it's a stop based on key technical levels. Your trading account is worth $10,000, and your risk management parameters allow you to accept up to 2% risk every trade.

What method would you use to determine the magnitude of your position? Here's how to do that in a few easy steps:

Step 1: Determine your risk-per-trade in terms of dollars. Your total loss should be no more than $200 ($10,000 x 0.02).

Step 2: Determine the size of your stop-loss order. The chart stop in our example is 40 pips in size.

Step 3: Determine your target pip-value in order to keep under your risk-per-trade limit. $200 divided by 40 pips equals $5 each pip. This is the maximum pip-value you can take.

Step 4: Calculate the position size that yields a $5 pip-value. Because one standard lot of EUR/USD has a pip value of $10, your maximum position size is 0.50 lots, or 50.000 euro units.

Here are a few major insights from stop-loss trading:

- Keep an eye on the R/R ratio: To take advantage of the notion of huge numbers, a stop-loss should be smaller than the potential profit of a transaction. Even with a 50% win rate, you'll be able to expand your account over a given sample of deals.

- Stop-losses should always be put by looking at what the chart is signalling as a critical technical level. You don't want to continue in the trade until a big support or resistance level has been broken. Other stop-loss types, such as chart stops, frequently produce greater outcomes.

- Guaranteed stops: If you don't want slippage or market conditions to affect the execution of your stop-loss order, use guaranteed stops, which guarantee that your stop will always be triggered at the pre-specified level.

- The term "invalidation area" pertains to the concept of chart stops. Set your stop in a zone where the trade idea will be nullified if the zone breaks.

- Allow for market volatility: Always give enough margin to your stops to avoid being stopped out by typical market noise. For example, if you've found a strong support level around 1.1050 and want to go long, add 20 pips of leeway and set your stop at 1.1030.

- In trending markets, utilise automatic trailing stops with a size equal to the average price-correction (counter-trend move) of the active trend to stay as long as feasible inside the trend.

- Follow the 2% rule: Never risk more than 2% of your total trading capital on a single trade. Consider lowering your risk-per-trade to 1% as your account rises. Even if you have a streak of poor transactions, this allows you to stay in the game for longer.

- Tighter stops offer greater profit potential: the tighter the stop, the more leverage you can employ and the greater the profit potential.

- Position sizing: Always size your position based on the distance between your stop-loss level and your stop-loss level, not the other way around.

.png)

.png)