|

| Explanation of the Forex Arbitrage Trading System |

Forex arbitrage trading methods have been around for a long time because, when done correctly, they provide a low-risk profit possibility. The basic goal is to profit from price disparities across exchanges by spotting mispricings immediately. A trader buys the underpriced instrument while selling the overpriced instrument right away, profiting from the difference in pricing.

Let's take a closer look at the most common arbitrage methods in the forex market and see if they may help retail traders build their trading accounts.

What is Arbitrage and how does it work?

Arbitrage is a type of trading in which a trader searches for short-term price differences in an underlying instrument across many exchanges. As a result, the trader buys an instrument on a low-cost exchange and sells the identical thing on a high-cost exchange. This ensures a quick profit without exposing the investor to the financial instrument.

Why is Arbitration a Possibility?

Market price is based on the flow of information, which means that pricing is not always accurate and that mispricing can occur. When traders hunt for arbitrage trading opportunities, different brokers may provide different pricing or effective prices. However, this normally only lasts a short time because traders who notice the mispricing buy the underpriced instrument while selling the overpriced instrument, bringing the price back into balance.

Arbitrage in the Forex Market: What Are the Different Types?

When it comes to the forex market, there are several forms of arbitrage that can be done:

|

| Arbitrage in the Forex Market: What Are the Different Types? |

Arbitrage between two currencies.

This entails trading the same currency pair with two distinct brokers at the same time. A trader goes long with a broker who gives a low exchange rate, then goes short with a broker who offers a higher rate. As a result, you have no direct exposure to the currency, and you can benefit once the price differential has vanished. Eventually, the prices of all brokers should be the same.

For example, broker A quotes EUR/AUD at 1.8950, whereas broker B quotes 1.8955. As a result, purchasing at broker A while selling at broker B allows you to generate a possible profit of 5 pips. You effectively gain 5 pips if the price at broker A moves up 2 pips and the price at broker B falls down 3 pips. The price differential will ultimately narrow, and you will be able to close both trades.

Daniel J. Fenn, according to Fenn, "...a study examining exchange rate data provided by HSBC Bank for the Japanese yen (JPY) and the Swiss franc (CHF) found that, while a limited number of arbitrage opportunities appeared to exist for as many as 100 seconds, 95% of them lasted for 5 seconds or less, and 60% lasted for 1 second or less," according to et al (2009). Furthermore, the majority of arbitrage opportunities were discovered to be of minor magnitude, with 94 percent of JPY and CHF chances being at a differential of 1 basis point, implying a possible arbitrage profit of $100 every $1 million transacted."

The bulk of arbitrage possibilities between the Swiss franc and the Japanese yen lasted barely 5 seconds or less, according to this research paper, putting manual traders at a significant disadvantage versus those who use automated trading algorithms. It would be nearly impossible for most manual traders to place a trade, complete with SL and TP levels, in less than 5 seconds (notice that 60% of all arbitrage chances lasted only 1 second or less!)

An automated way to trading price disparities in the markets is required for a successful arbitrage strategy. Furthermore, because most disparities have relatively small magnitudes, the required capital to generate a significant return is extremely expensive.

Arbitrage in three dimensions.

This entails simultaneously trading three distinct currencies. The basic concept is straightforward: the trader seeks out a base currency that is expensive against one currency but underpriced against another.

Consider the following scenario: EUR/USD is trading at 1.1600, while GBP/USD is trading at 1.33. We should get the EUR/GBP price of 0.87218 by dividing these two rates. As a result, if the actual EUR/GBP price differs from our predicted price, there is an arbitrage opportunity.

Let's pretend the current EUR/GBP exchange rate is 0.87318. To take advantage of this arbitrage opportunity, a trader might sell EUR/GBP while simultaneously opening two EUR/USD and GBP/USD trades with the same effective transaction size to generate a synthetic counter position. Once this is done, the trader effectively has no market exposure and has locked in the price differential.

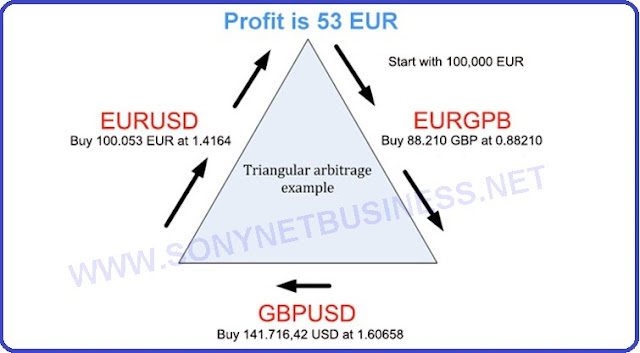

Example of Triangular Arbitrage.

This may appear confusing at first, so let's look at another example of triangular arbitrage. Assume the EUR/USD is 1.1340, the USD/CAD is 1.3000, and the EUR/CAD is 1.4735. As you may be aware, buying the base currency and selling the counter-currency in an equal amount and at the current market exchange rate is going long in a currency pair.

Because the USD/CAD exchange rate is 1.3000, being long one standard lot in USD/CAD means you're long 100,000 USD units and short 130.000 CAD units.

To identify mispricings, triangular arbitrage entails calculating the intrinsic value of a currency pair. That's it; all you have to do is multiply the EUR/USD exchange rate by the USD/CAD exchange rate to get the intrinsic value of EUR/CAD.

EUR/CAD Intrinsic Exchange Rate = EUR/USD 1.1340 x USD/CAD 1.3000 = 1.4742

As a result, the EUR/CAD intrinsic exchange rate is 1.4742, whereas the broker's actual exchange rate is 1.4735. A trader may buy $113.400 for €100.000 (EUR/USD at 1.1340), exchange the $113.400 for C$ 147.420 (USD/CAD at 1.30), and then exchange the C$ 147.420 for €100.048 (EUR/CAD at 1.4735), resulting in a great arbitrage opportunity.

This arbitrage trade, starting with €100.000, would return €100.048, or a total risk-free profit of €48 per standard lot traded. Naturally, the most convenient method is to employ an automated trading algorithm that does all of the calculations for you.

To make a significant trading profit from forex arbitrage possibilities, traders must act quickly and trade on high leverage. On the market, there are numerous currency arbitrage calculators that scan exchange rates for real-time arbitrage chances. Because the majority of those calculators are marketed by third parties, their real-time price quotes may differ from your broker's.

If you opt to use a real account to test arbitrage calculators, make sure your broker supports automated trading (for example, through MetaTrader EAs) and that your trading account allows for hedging.

Statistical Arbitrage in the Forex Market.

Aside from the two-currency and triangle arbitrage techniques, statistical arbitrage is another interesting trading approach for exploiting pricing disparities in the forex market.

Statistical arbitrage entails purchasing an underperforming currency basket and selling an overperforming currency basket in order to profit from the market's mean-reverting characteristic. The premise underlying statistical arbitrage is that currencies that have outperformed on average will have to decline in value in order to attain their fair exchange rate, while currencies that have underperformed on average would have to rise in value. Statistical arbitrage, unlike other types of arbitrage, is not totally risk-free because traders expect currency pairs to revert to their fair value over time.

In order to establish a market-neutral portfolio, statistical arbitrage takes advantage of currency correlations in the market. Furthermore, statistical arbitrage deals take a long time to execute, often months, implying that trades can be manually submitted. While statistical arbitrage has an advantage over two-currency and triangle arbitrage, it still necessitates a large trading account to resist long-term unfavourable price movements. To avoid a margin call when trading on margin, traders must ensure that they have enough free margin in their trading account.

Arbitrage of Interest Rates.

Covered interest rate arbitrage is a method in which traders hunt for interest rate differentials in the forex market in order to invest in a higher-yielding currency while hedging their exchange rate exposure with a forward contract.

Traders must, of course, assess the expense of hedging against the potential profit from investing in a currency with a higher interest rate. If the cost of hedging is greater than the potential return, the approach will result in a loss rather than a profit. Covered interest rate arbitrage, like other arbitrage schemes, has low returns and requires a large initial capital investment.

Arbitrage Strategies' Risks.

While arbitrage is frequently thought to be a risk-free earning potential, it is not.

Because current financial markets only detect little and short-term differences, it's critical to execute arbitrage deals at the same time. Otherwise, any possible profit could be lost if currency rates change by the time you complete your second trade. You may even lose money as a result of this.

Furthermore, any broker fees, swaps, or spread differences can quickly deplete any profit potential. Because arbitrage possibilities are typically minor, a sudden increase in the spread during the execution phase can make all the difference. Every pip matters in arbitrage.

As a result, ensure that your broker provides quick execution and that the difference in exchange rates is substantial enough to generate a profit after all additional trading expenses are eliminated.

Capital Requirements and Leverage in Arbitrage.

To make a significant profit through arbitrage, you'll need a lot of money and a lot of leverage. Because the price variations are so modest, returns will be little if you don't take a significant risk.

Another problematic scenario is if one of the brokers involved in the deal has technical difficulties, such as being unable to settle a position. If the counter position has already been closed, enormous losses might occur swiftly.

The majority of traders that use a successful forex triangle arbitrage technique work directly with banks that can offer the best exchange rates and spreads. Retail traders have the disadvantage of having small accounts, as making a little risk-free gain requires millions of dollars. While leverage can help lessen this risk, keep in mind that leverage is a double-edged sword that can result in large losses if a trade doesn't go as planned.

The majority of large banks have created sophisticated trading algorithms that monitor the market for pricing anomalies and arbitrage opportunities. The size of the trade swiftly removes any profit possibilities for less-capitalized traders without a comprehensive trading infrastructure once they find a trading opportunity.

Important Points to Remember.

- A trader uses arbitrage tactics to look for short-term mispricing in underlying instruments by simultaneously buying the undervalued one and selling the overpriced one.

- If properly implemented, immediate profit can be generated without any real exposure to the financial instrument.

- The most popular types of forex arbitrage are two-currency arbitrage and triangular arbitrage.

- Statistical arbitrage, which can be done manually, is another prominent arbitrage approach. Trades, on the other hand, can persist for months.

- Because the spread of mispricing is typically tiny, huge amounts of cash and leverage are required to generate gains.

- Mispricing in the market rarely lasts long, therefore quickness of execution is critical.

- Brokerage fees, swaps, and spread variances can quickly eat into any profit potential.

Final Thoughts.

By taking advantage of pricing differences between multiple exchanges, arbitrage provides a nearly risk-free profit potential in the markets. The fundamental issue for retail traders is that mispricings only last a few seconds, making the use of an automated trading technique nearly obligatory. Statistical arbitrage, for example, entails buying underperforming currencies and selling overperforming currencies in order to profit from prior correlations and the mean-reverting structure of markets. Statistical arbitrage trades can go on for months.

Before getting your feet wet with arbitrage methods, you need consider market liquidity, volatility, and broker spreads/commissions, in addition to trading on high leverage and coping with highly short-lived mispricings.

.png)

.png)