|

| How Does a Crypto Trading Bot Work? |

The crypto market has experienced a significant growth in demand for crypto trading. As a result, many people are interested in giving it a try. Despite the fact that bitcoin and market volatility are significantly more sophisticated, there is a growing need for trading bots.

In many ways, some people find the wealth of trading knowledge and approaches overwhelming. As a result, the prospect of completing all of their projects and learning numerous trading signals on their own becomes daunting. Regardless of the circumstances, trading can be made into a full-time employment.

As a result, many traders are adopting automated algorithmic trading strategies, often known as crypto trading bots, to execute their trades. Similarly, to trade faster and better in less time. You can, however, choose to trade cryptos using automated software. Overall, there is still important knowledge that you must get as a trader before you can be a good trader.

Furthermore, it is vital to understand that using automated trading does not guarantee that you will make large profits. To avoid losing your hard-earned money in this trading function, take everything that is offered and become familiar with the strategies you choose to employ.

What Is a Crypto Trading Bot and How Does It Work?

Crypto trading bots are a type of automation that makes performing transactions based on rules easier. Using an Application Programming Interface (API) — a software mediator that allows two apps on a network to connect. This programme connects to your existing exchanges and performs trading strategies on your behalf.

Depending on how it's set up, the programme can use a variety of algorithms to gather revenues for you without requiring any additional input. Many consumers purchase trading software without first understanding how the programme works.

Additionally, people occasionally inquire about the practicality of trading bots. Amateur traders, for example, are frequently perplexed by how these bots work, and it is critical to understand that this is not a hands-off investment in the classic sense.

This is due to the fact that if you want to create a passive income in the cryptocurrency market, you will undoubtedly need to learn at least some crypto trading basics.

What are cryptocurrency trading bots and how do they operate?

Trading bots offer superior speed and efficiency, as well as fewer errors, by dealing directly with crypto exchanges and placing orders automatically depending on your established requirements.

Allowing a trading bot access to your account via API keys is required to trade on an exchange. This permission can be granted or revoked at any moment.

To be more specific, crypto trading bots operate in three stages: signal generation, risk allocation, and execution.

- The traders' work is done by the signal generator, which makes forecasts and determines prospective trades based on market data and technical analysis indicators.

- Risk allocation is when a bot spreads the risk based on a set of parameters and regulations established by the trader, which typically include how and to what extent money are distributed during trading.

- The execution phase is when cryptos are purchased and exchanged depending on the signals given by the trading system that has been pre-configured. The signals will now be converted into API key requests, which the crypto exchange will be able to comprehend and handle.

What Are the Advantages of Crypto Trading Bots?

Trading bots have a higher memory capacity and faster computation speeds, which means they are more accurate. Along these lines, traders frequently inquire about the effectiveness of trading bots when used as trading tools. The computer, on the other hand, begins real-time computations and simulations over a thousand times faster than a human and makes no errors.

Errors made by humans

There are too many factors in human error, such as distractions, emotion, and the current tendency to act on instinct rather than logic. The machines, on the other hand, only respond to the inputs they get. As a result, giving the machine the correct inputs will ensure that the appropriate actions are executed.

Trading bots will also execute your orders, tactics, and inputs. However, they will only be able to work within a certain set of parameters. These devices have been programmed to accept and carry out the commands that are provided to them.

At the moment, machines available to the general public appear to be little more than machines that run a few lines of code to engage in market behaviours like scalping, arbitrage, and other types of trading.

Furthermore, it is critical to understand that the existing automated crypto market solutions will not provide the entire spectrum of speculative possibilities. This means the software isn't flawless on its own; you'll still need to provide the trading bot software with data.

Trading bots can multitask and operate at the same time.

Crypto trading bots are profitable because they perform multiple tasks at the same time. It would be difficult for a human to simultaneously work as a market maker and a scalper in two different marketplaces while trading numerous cryptocurrencies across multiple exchanges.

A trading bot would also learn about the markets, participate in them, and continue to trade as long as the conditions were favourable for each of the tactics it was given.

Overall Pace

To gain an advantage on the stock market, several people use high-frequency computers. Computers, as we all know, are faster than humans at performing computations and trading.

Expert cryptocurrency traders will also employ a variety of equipment and system settings to boost their overall speed. Digital asset automation can be accomplished through the employment of a DCA bot or another way.

In the end, a trading bot operates based on the techniques and data you provide. As a result, things like:

- Human emotions;

- human errors;

- poor timing;

- apprehension;

Above all, they are eliminated from the equation. Furthermore, the trader is not required to be seated in front of a computer screen 24 hours a day, seven days a week.

Acting on Inputs and Market Patterns

It is critical to note that these tools are effective. Because they are able to read marketplaces and comprehend the techniques that will be required in the marketplace. But also to carry out the activities and make necessary adjustments to the posture.

As a result, whether you are investing for the long term or trying to implement strategies that are only intended to be employed for a limited time, you should keep this in mind. Furthermore, the trading bots will adjust their performance based on your risk tolerance and the approach you select.

More crucially, if you connect them to market feeds, they'll have access to more information and be able to take greater action. Even if the software is provided data directly, the human brain is still required to understand data connected to speculation and other aspects of life that affect the market.

Strategies

Scalping is a trading strategy employed by crypto trading bots to profit from tiny price fluctuations. Furthermore, it is a common trading strategy used by human traders. Although, due to the vast number of little transactions required to make a profit, it may be time-consuming.

As a result, trading bots come in helpful for this unique method. Because they automate the process, you can have the bot trade for you anytime the correct conditions arise without having to be present. You can make money without spending all of your time in front of the computer if you use this strategy.

What to Look for When Choosing a Crypto Trading Bot

Crypto traders can choose from a growing number of efficient automated trading platforms. Furthermore, it aims to simplify the entire process and enable everyone to make the most of their trading opportunities.

Investors and professional traders are looking for ways to automate their actions in this climate. Furthermore, they simplify and streamline their lives in a variety of ways, including financial.

Credibility

It is impossible to overestimate the importance of conducting extensive research on the software you intend to use, and you should avoid purchasing the first trading bot you come across.

Similarly, these tools could be produced by anyone, and they will require access to your exchange account in order to function. As a result, when selecting a solid crypto trading bot, dependability is critical.

Examine the industry's and the crypto trading community's reputations to see how satisfied they are, and whether it is dependable, effective, and trustworthy.

Traders should also consider the developer's customer service and how long they've been in business. Trading software isn't always inexpensive, and you want to make sure that the company that built it will continue to provide upgrades and support to its customers.

Exchanges

You should also keep in mind that not all trading bots are compatible with all cryptocurrency exchanges, so make sure the bot you choose is compatible with your favourite platform before purchasing it. In fact, the only way to make a good trading bot function is to make it work the way you want. However, in the locations that you designate.

Settings

You should also consider the numerous options and characteristics available. A crypto trading bot isn't a magic solution that makes money right away. It's a tool that will need to be tweaked to be successful, and good software will provide a plethora of customization choices.

The Dangers of Trading Bots

Using a trading bot, of course, is not completely risk-free. As a result, users should exercise caution and pay close attention. However, before using a trading bot, users should be familiar with the fundamentals of trading. Furthermore, customers must practise particular market tactics before using the virtual trading bot on the platform.

|

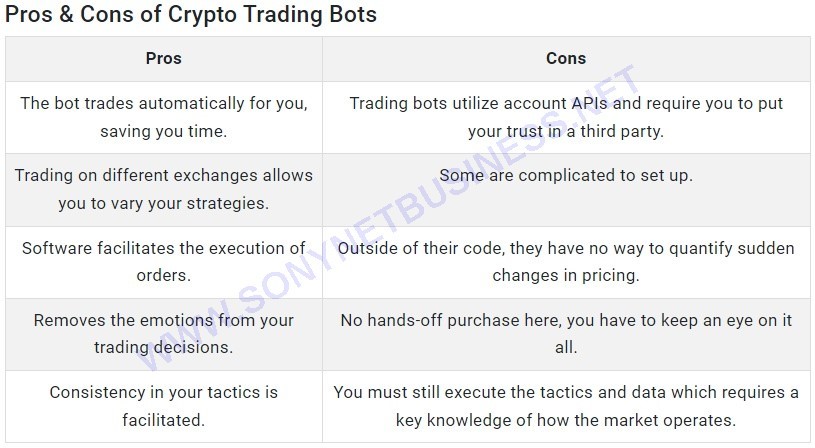

| The Benefits and Drawbacks of Crypto Trading Bots |

Conclusion

Finally, it's crucial to remember that crypto trading bots are merely tools, and even the most advanced of them are subject to the whims of the crypto market and its fluctuations.

It's crucial to understand that they aren't a magical technique to make money without putting in any effort or conducting your own research on how to apply specific strategies to generate cash. However, if you are ready to put in the time and effort to learn how they function and set them up properly, they could be really beneficial.

Normally, crypto investors will take precautions to safeguard their funds. Those who employ automated systems, on the other hand, should take special precautions to protect their assets.

We are aware that there are various sorts of software applications available for trading cryptocurrency. Not all trading bots are created by persons that promote their programme with your best interests in mind.

Disclaimer : This information should not be utilised to make any investment decisions. This is solely for the purpose of providing information about the bitcoin Trading Bot. Trading digital assets has a high level of risk and can result in a loss of funds. As a result, always conduct thorough research before dealing in or investing in any cryptocurrency.

.png)

.png)