|

| What are forex trading robots and how do they work? |

Trading the markets can become tiresome after a while, especially if you do the same thing every day. You examine the charts every day, looking for the same setups, setting the same target and stop loss levels, and then entering a trade. If you've been doing this for a while, you'll most likely be seeking for a means to automate the process. In this instance, you'll need a trading robot to carry out the routine on your behalf.

Trading robots are computer programmes that trade for you even when you are not in front of your computer screen, or they assist you in your trading by sending you notifications when particular market events occur. Depending on your strategy and requirements, these instances may differ. A crossover on the MACD indicator, for example, is a popular signal. You may programme the trading robot to respond to any precise indication or alert. A trading robot is a fantastic tool that saves you time by scanning the market on your behalf and allowing you to do other things while they trade for you.

A trading algorithm is generally built into trading robots, which advises them when to purchase and sell. The algorithm normally incorporates many more rules, such as money management approaches, in addition to the buying and selling rules. The amount of each trade in relation to the account's capital, rules for scaling in and out of positions, and other risk management approaches are among them.

Expert Advisors (EAs) are the most common trading robots available, and they may be utilised on the popular MetaTrader 4 (MT4) or MetaTrader 5 platforms (MT5). Many of those trading robots are available on the market and may be used with MT4 and MT5 (by simply clicking on the market tab). Some of the EAs are available for free download and usage, while others need payment. Both the MT4 and MT5 markets have a large number of EAs to pick from. Trading robots are available for scalpers, long-term traders, and everyone in between.

MT4 and MT5 Expert Advisors

MT4 and MT5 have a lot of similarities and differences. Both provide good trading experience and access to a vast tool market. The MT5 platform, on the other hand, offers two additional pending order types: buy stop limit and sell stop limit. These are pending orders that will only be executed if the price reaches a specified level. MT5 adds eight new technical indicators and thirteen new graphics items.It also has more timelines and other useful features that MT4 does not have. When it comes to testing robots (EAs), MT5 provides more precise back-testing data. This is because MT5 testing is multithreaded (which speeds up the process) and can test the strategy or EA on different currencies with actual ticks at the same time. It should be noted, however, that most MT4 EAs do not work on MT5 without some adjustments. Before your MT4 EA may work on MT5, it must be converted.

How to evaluate trading robots before making a decision

There are numerous performance indicators to consider when evaluating a trading robot to install or acquire. Those metrics are usually divided into two groups: profitability and risk. These indications assist you in selecting a trading robot that is compatible with your risk tolerance level while still allowing you to achieve your trading goals. You'll frequently have to establish a balance between the two types of indications.

Go to the "market" tab on your MT4 or MT5 platform, and then to the "experts" tab. There you will find a list of all the EAs that are currently available on the market. You can learn more about an EA by clicking on it if you've found one you like. A description of the EA and its approach may be found there. Details about the EA's performance can be found under the "screenshots" tab.

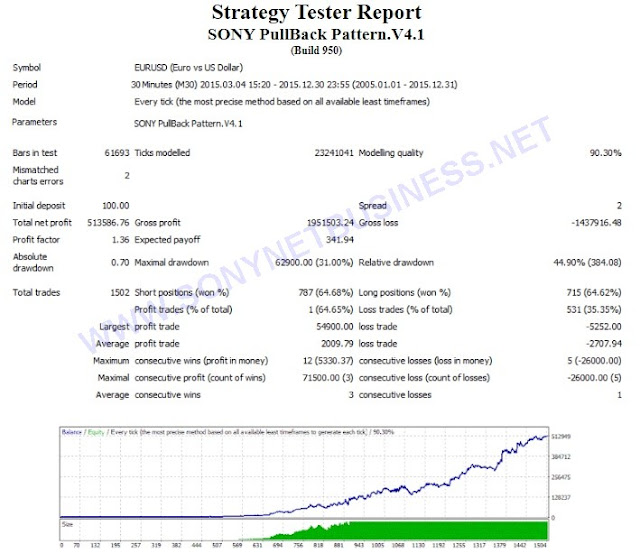

Back-testing results are generally used to create screenshots. Here's an example.

|

| What are forex trading robots and how do they work? |

There is a lot of valuable information in the above test result. The MT4 back-tester allows you to test an EA on each currency pair separately, allowing you to determine which currency pairs are best for the EA. The EA was tested on the GBPUSD pair in the previous article. You can observe the timeframe in which the robot was tested, which in this case was 15 minutes. The testing model is crucial since the test results can vary dramatically depending on the model. The above-mentioned model is "every tick," which means the back-tester has gathered and considered every price data point at the tick level.The "every tick" methodology yields the most precise and accurate results. This means that when you use the EA on your account, the results will be quite similar to the test results. Other test models require the tester to collect fewer data points, lowering the quality of the results.

The initial deposit, which you can manually set when preparing the test, is also included in the test results. It is suggested that you utilise the same initial deposit in the test that you intend to have in your account. When you start utilising the robot, you'll have a better idea of what to expect in terms of actual results. You'll also see the number of winning trades, the number of lost trades, the gross loss, and the gross profit on the test report.The profit factor is just the average return on a one-dollar investment. If your profit factor is 1.39, for example, you will benefit 39 cents (or 0.39 USD) for every $1 you invest. Your profit factor should be more than one. Otherwise, any number less than one implies that you are losing money. The maximum drawdown reveals how much your equity has dropped in value since its peak. The relative drawdown illustrates how much equity has been lost in percentage terms since the top. Both numbers are essential for managing your money, but when evaluating a robot, the drawdown should be your primary criterion. The profit component, as well as other profitability indicators, should be placed second.

What if you have a trading strategy and want to create a trading robot to execute it for you?

If you have a good trading technique and want to automate it, you don't need to have any coding skills. Many applications are available, some of which are free, to assist you in creating your own EA based on your own approach. A simple Google search for "free expert advisor builder" will reveal a plethora of free solutions for creating your trading robot. However, one disadvantage of trading robot builders is that they usually only enable you to insert a limited number of rules into the EA. This isn't a problem if your strategy only has a few rules, but it can be restrictive if you're using a complex approach with a lot of rules.

Often, the builder will allow you to download a file that you must save to your MT4 data folder. After that, you may put the robot through its paces. The test will allow you to double-check the results before optimising them. Optimization allows you to choose the best parameters and settings for your robot in order to maximise its profitability.

In addition to EA builders, many firms typically offer wizard-based applications that assist you in creating your own trading robot. Simply enter your strategy's rules and other details, and the programme will generate the code, which the robot will then execute. Furthermore, some firms provide automated trading services, in which you make a deposit, the broker pools the funds, and the funds are then traded automatically by a single robot.

Companies that provide this service will normally show you the trading robot's outcomes first. Rather than bask-tested findings, those are frequently the actual results. Future performance, on the other hand, does not have to be a carbon copy of previous performance and can differ. As a result, it's critical that you learn more about the trading strategy before entrusting your money to a robot that you can't always control.

The requirement for a private server in order to keep your trading robot functioning

To use your trading robot (EA) on your account after you've chosen and tested it, you'll need a virtual private server (VPS). If your MetaTreder platform is open and connected to the internet, it will only conduct trades. Even if your computer is turned off, your trading robot will continue working and executing trades on your behalf with a VPS.

Most forex brokers provide virtual private servers (VPS) that you can hire for a monthly charge. Depending on the source, this price ranges from $5 to $25. Regardless of the cost, it is critical to evaluate the server and execution quality. The results you get from your EA can be distorted by high slippage, technical mistakes, and poor execution. Investing in a high-quality VPS ensures that you get the best results possible.

The benefits and drawbacks of trading robots

One of the most significant advantages of utilising a trading robot is that it reduces trading emotions. Because the market moved considerably, your robot will not modify the stop loss level or close the deal early. Psychological factors will be eliminated because the robot will usually commit to the levels you establish for it.

Despite this advantage, most trading methods are only effective under certain market conditions. As a result, the outcome of your trading robot can differ from one time period to the next. Your robot may perform well in trending markets, but it will perform poorly in sideways markets. Traders generally like to interfere from time to time to optimise the outcomes, even though you can configure your robot to adjust its strategy dependent on market conditions. The robot in this situation would be a semi-automated robot.

Robots that are semi-automated

Semi-automated trading robots will almost always necessitate some trader involvement. For example, the robot can send you an alert when a specific event occurs in the market, such as when the Ichimoku cloud's momentum indicator falls below the cloud from its peak. After that, you can either enter a transaction or ignore the alert when you see it. Semi-automated systems combine the advantages of fully automated systems with the elimination of some of their drawbacks. They also allow the trader more room to make decisions during the trading process.

Trading robots and fundamental analysis

The majority of trading robots on the market use technical indications to enter and exit deals. This is due to the fact that certain technical rules and signals are simple to programme. While those robots are beneficial, they are not without flaws. They primarily lack fundamental analysis insights. Ignoring the fundamentals might cost you money and put you on the wrong side of the market. The majority of robots aren't sophisticated enough to include fundamental analysis in their algorithms.

While some trading robots can trade when crucial economic data is released, this is not the same as thorough fundamental analysis. Traders who use excellent fundamental analysis rely on a variety of indicators to make decisions, including growth trends, the performance of various sectors of the economy, inflation numbers, the likelihood of rate cuts or hikes, and many others. It's significantly more difficult to code such an analysis than it is to code a simple technical analysis technique. This helps to understand why the vast majority of trading robots are based on technical indicators.

Because fundamental analysis is frequently lacking from trading robot code, it is more practical to utilise a semi-automatic trading robot rather than a completely automated one. In general, robots that work in shorter time frames, such as scalping robots, should perform better because basic issues have a greater impact on longer time frames. Short-term market movements in the opposite direction of big underlying themes can occur, but they are less likely to endure over time.

This isn't to imply that artificial intelligence and machine learning can't perform technical and fundamental analyses on your behalf. Robots are, in fact, responsible for bigger trading volumes on the market now than they were previously. After all, both technical and fundamental analysis are types of data analysis, which falls within the artificial intelligence umbrella. Such advanced robots, however, are still difficult to come by at a fair price.

Last but not least,

Trading robots can be really beneficial, but you must first ensure that you have all of the necessary factors for success. A solid and dependable virtual private server, a good robot based on a strong trading approach, and a competent broker with minimal spreads are among these elements (especially if you use a scalping EA). Once you've found all of those elements, test the robot on a demo account for a respectable amount of time before using it on a live account.

Also, make sure the robot you choose is compatible with your personality. If you are a short-term trader, a robot that scalps the market is what you should be looking for (a short term strategy). You'll probably require a swing trading robot if you're a medium-term trader. If you are a long-term trader, you may be able to undertake your own analysis once every couple of weeks, eliminating the need for the robot.

Last but not least, even if you have a good robot, it's a good idea to keep up with market trends. The results of trading on the Yen pairs can be considerably influenced by a shift in sentiment from risk-on to risk-off. As a result, depending on the current theme, you may need to alter the robot's specifications from time to time.

Overall, robots are important tools, but human interaction is still required in the majority of cases.

.png)

.png)