Bitcoin has decoupled from stocks and continues to soar 10 years after the Cyprus banking crisis coincided with a BTC price surge.

In 2023, the market value of Bitcoin, which was $27,008, increased by $194 billion. Its 66% YTD growth far outpaces that of the leading Wall Street bank companies, especially at a time when concerns about a worldwide financial crisis are on the rise.

|

| BTC market cap daily performance chart. Source: TradingView |

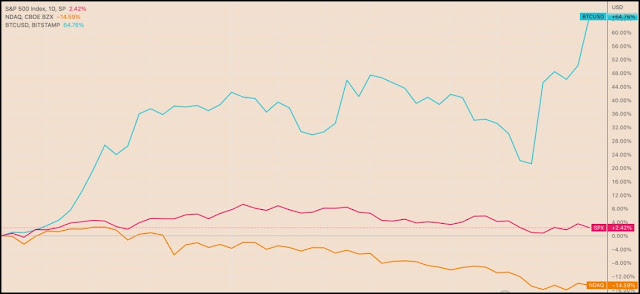

Furthermore, Bitcoin's price has increased nearly 65% compared to the S&P 500's 2.5% rise and the Nasdaq's 15% loss in 2023, decoupling it from American stocks for the first time in a year.

|

| SPX and NDAQ YTD performance vs. BTC/USD. Source: TradingView |

Wall Street banks lose $100 billion in 2023.

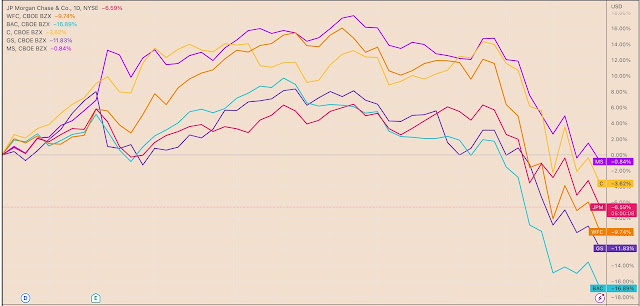

According to information obtained by CompaniesMarketCap.com, the market value of the six biggest U.S. banks — JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Morgan Stanley, and Goldman Sachs — has decreased by around $100 billion since the year's beginning.

With a valuation decline of almost 17% YTD, Bank of America's stock is the worst performer among the Wall Street banking players. With a nearly 12% YTD decline, Goldman Sachs is in last place, followed by Wells Fargo (9.74%), JPMorgan Chase (6.59%), Citi (3.62%), and Morgan Stanley (0.84%).

|

| Wall Street banks YTD performance. Source: TradingView |

In the midst of the ongoing regional financial collapse in the US, U.S. bank valuations have fallen. That includes the closure of the crypto currency-friendly bank Silver gate being announced last week, as well as the following seizure of Signature Bank and Silicon Valley Bank by regulators.

The near-collapse of First Republic Bank, which was salvaged at the last minute by a $30 billion injection from Wells Fargo, JPMorgan Chase, Bank of America, and Citigroup, among others, contributed to the expansion of the crisis.

Greece and Cyprus: a rerun?

Similar to how it responded to the financial catastrophes in Cyprus and Greece, Bitcoin is on the rise as the U.S. banking crisis intensifies.

BTC's price increased by much to 5,000% during the 2013 Cyprus financial crisis, which was brought on by Cypriot banks' exposure to heavily leveraged local real estate firms.

|

| BTC/USD performance during Cyprus banking crisis. Source: TradingView |

In order to prevent a bank run, Cyprus's government closed all banks in March 2013.

Bitcoin's price increased by 150% in 2015 when Greece faced a similar crisis and implemented capital controls on residents to prevent a bank run.

|

| BTC/USD performance during the Greece banking crisis. Source: TradingView |

Ilan Solot, co-head of digital assets at London broker Marex, said that concerns over the soundness of the financial system "provide a nice climate for Bitcoin to rebound," noting that some investors "view the cryptocurrency as a hedge against systemic risks."

There are no recommendations or investment advice in this post. Every trading and investment decision carries risk, so readers should do their own research before choosing.

.png)

.png)