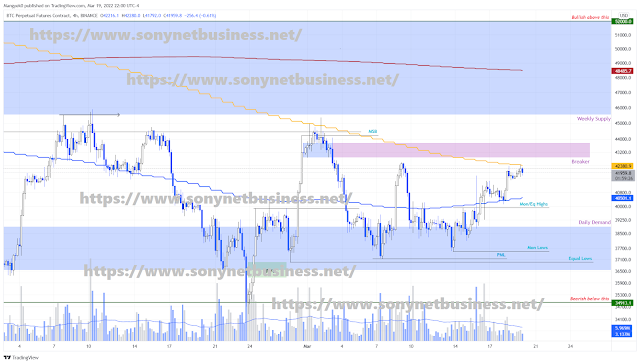

As it reaches the $45,000 local top, bitcoin faces a slew of opposition. A retest of the bearish breaker at $42,867 to $43,755 will almost certainly result in a downturn to $38,889 and below. Any negative argument will be debunked if the daily candlestick closes above $52,000.

After an almost week-long strut-up, Bitcoin is approaching its upward limit. A reversion to steady support levels for BTC is probable due to the presence of many impediments.

|

| As BTC bulls approach the local top |

The price of bitcoin is at a crossroads.

After hitting a low of $37,524 on Monday, the bitcoin price has rallied nearly 13%. This gradual move aims to retest the bearish breaker, which extends from $42,867 to $43,755. Between February 28 and March 2, there was a Market Structure Break (MSB) meaning a higher, followed by a flip of the demand zone formed between the swing highs.

BTC broke through the indicated demand zone, which ran from $42,867 to $43,755, on March 3 and turned it into a bearish breaker. This technical pattern indicates that a flashback that leads to a retest of the breaker will be met with strong resistance. Bulls will also find it difficult to push BTC higher due to the presence of the 100-day Simple Moving Average (SMA) at $42,380. As a result, there's a potential the huge coin will be prematurely rejected by the 100-day SMA, triggering a downtrend.

Regardless, Bitcoin's price is expected to retrace to Monday's low of $37,524. BTC may fall to fill a small Fair Value Gap (FVG) ranging from $36,170 to $36,966 in some situations. This downtrend would result in a 15% loss overall, and it is likely that Bitcoin will develop a local bottom before establishing directional bias.

Bitcoin's price, on the other hand, might break through the breaker and retest the weekly supply zone, which runs from $45,551 to $51,966. A move like this would invalidate the bearish premise. This increase, however, does not signal the commencement of a bullish trend. For this to happen, Bitcoin's price must close above $52,000 on a daily, preferably weekly basis.

.png)

.png)